Estate Planning Lawyer Great Falls, MT

When you are planning your estate, a trusted Great Falls, MT estate planning lawyer knows that a DIY estate plan can go horribly awry. It’s easy to fall into the trap of believing that creating your own estate plan will take less amount time and save you a great deal in the long run. Why pay a lawyer to do what the Internet can do, right? However, you may quickly find that these DIY estate planning templates will not have everything that you need and will likely not be able to fulfill all of the requirements that your state needs to be fulfilled for an estate plan. When you want to see what a lawyer can do for you, reach out to Silverman Law Office, PLLC for more information.

When you are planning your estate, a trusted Great Falls, MT estate planning lawyer knows that a DIY estate plan can go horribly awry. It’s easy to fall into the trap of believing that creating your own estate plan will take less amount time and save you a great deal in the long run. Why pay a lawyer to do what the Internet can do, right? However, you may quickly find that these DIY estate planning templates will not have everything that you need and will likely not be able to fulfill all of the requirements that your state needs to be fulfilled for an estate plan. When you want to see what a lawyer can do for you, reach out to Silverman Law Office, PLLC for more information.

Estate Planning Lawyer Services for Your Peace of Mind

When it comes to securing your family’s future and ensuring that your hard-earned assets are distributed as per your wishes, a trusted Great Falls estate planning lawyer can be your greatest ally. Our team of experienced and dedicated estate planning lawyers are here to guide you through the intricacies of estate planning, allowing you to make informed decisions for the benefit of your loved ones.

Understanding the Importance of Estate Planning

Estate planning is a crucial aspect of financial and personal security, yet it’s a topic that often gets overlooked or postponed. Without a proper estate plan in place, your assets may be subject to probate, potentially leading to delays, disputes, and unnecessary expenses for your heirs. This is where our estate planning lawyers step in, offering comprehensive solutions tailored to your unique circumstances.

Crafting a Customized Estate Plan

We believe that estate planning is not a one-size-fits-all endeavor. Our experienced lawyers take the time to understand your specific needs, goals, and family dynamics to create a personalized estate plan that addresses your concerns. Whether you require a simple will, a trust, or a more complex estate planning strategy, we have the expertise to ensure your wishes are upheld.

Protecting Your Assets and Legacy

Our estate planning lawyers are dedicated to safeguarding your assets and preserving your legacy. We help you navigate the intricacies of tax laws and asset protection, minimizing potential liabilities and maximizing the inheritance your loved ones receive. With our guidance, you can have peace of mind knowing that your hard-earned wealth is in capable hands.

Planning for Incapacity

Estate planning isn’t just about what happens after you pass away; it also involves planning for potential incapacity due to illness or injury. Our lawyers can assist you in establishing powers of attorney and advance healthcare directives, ensuring that your affairs are managed according to your wishes if you become unable to make decisions for yourself.

Administering Estates Efficiently

In addition to helping you plan for the future, a Great Falls estate planning lawyer can also guide your loved ones through the probate and estate administration process. We understand that this can be a challenging time, and our compassionate approach ensures that your family’s interests are protected throughout the proceedings.

The Silverman Law Office, PLLC Difference

We take pride in our reputation for excellence and our commitment to client satisfaction. We provide top-notch legal guidance to their employees and clients, ensuring their assets are secure for generations to come.

Take Control Of Your Legacy Today

Don’t leave the future of your estate to chance. Our estate planning lawyers are ready to assist you in creating a comprehensive plan that reflects your wishes and protects your loved ones. Contact us today to schedule a consultation and take the first step towards securing your legacy. An experienced Great Falls estate planning lawyer provides tailored solutions to meet your unique needs, ensuring your legacy is preserved for generations to come. With the support of our dedicated team, you can take control of your estate and enjoy peace of mind. Contact us today to schedule a consultation and embark on your estate planning journey.

Understanding Estate Planning: Essential FAQs

Estate planning is a crucial process that ensures your assets are distributed according to your wishes upon your passing. It involves legal structures like wills, trusts, and powers of attorney. Understanding the essentials of estate planning can be challenging, which is why it’s important to speak with a Great Falls, MT estate planning lawyer for support. Our team has taken the time to compile some frequently asked questions to guide you through this vital journey.

What Is Estate Planning And Why Is It Important?

Estate planning is the process of arranging the management and disposal of your estate during your life and after death. It’s important because it allows you to ensure that your assets are distributed according to your wishes, reduces taxes, and helps your loved ones avoid complicated legal processes. As our team from Silverman Law Office, PLLC, will share, effective estate planning gives you peace of mind knowing that your assets are protected and your family’s future is secure.

How Does A Will Differ From A Living Trust?

A will is a legal document that specifies how your assets should be distributed after your death. It becomes effective only after you pass away. A living trust, on the other hand, is effective immediately upon creation. It allows you to manage your assets during your lifetime and dictates distribution after your death. Living trusts are often preferred for their ability to avoid probate, which can be a lengthy and costly process.

What Happens If I Don’t Have An Estate Plan?

Without an estate plan, state laws determine how your assets are distributed, which may not align with your wishes. Your family could face lengthy legal processes, and your estate might incur more taxes and legal fees. Creating an estate plan with a Great Falls estate planning lawyer ensures that your intentions are clear, legally binding, and that your loved ones are taken care of according to your desires.

Can I Update My Estate Plan?

Absolutely! Life changes such as marriage, divorce, birth of a child, or acquisition of significant assets necessitate updates to your estate plan. Regularly reviewing and updating your plan with an estate planning lawyer ensures it always reflects your current situation and wishes. Remember, an outdated estate plan can be as problematic as having no plan at all.

What Should I Look For In An Estate Planning Lawyer?

Choosing the right Great Falls estate planning lawyer is critical. Look for a lawyer with specialized knowledge in estate planning, a strong track record, and excellent client reviews. A good lawyer should understand your unique needs, offer tailored advice, and ensure your estate plan is comprehensive and legally sound.

Next Steps

Estate planning is a profound step towards securing your legacy and protecting your loved ones’ future. At Silverman Law Office, PLLC, we’re committed to guiding you through each stage of this important journey. Our experienced team will work closely with you to create an estate plan that meets your specific needs and gives you peace of mind.

If you’re ready to start your estate planning journey or have more questions, don’t hesitate to reach out to us. Together, we will ensure your legacy is preserved exactly as you envision.

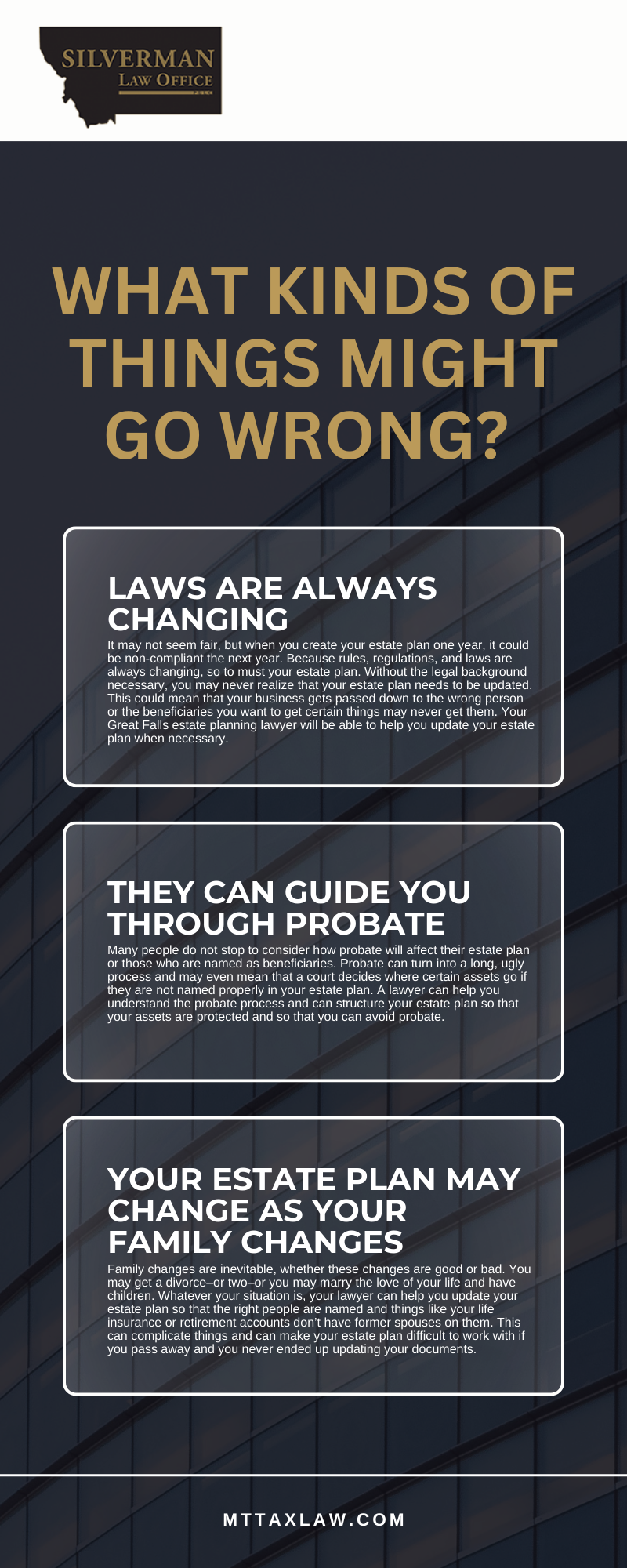

What kinds of things might go wrong?

It’s easy to focus on the positives of a DIY estate plan. You can throw it together on your own in an afternoon and you may have only paid a hundred bucks to download the template. Easy, right? Before you do this, consider what could go wrong if you do not have a lawyer guiding you through the process.

- Laws are always changing. It may not seem fair, but when you create your estate plan one year, it could be non-compliant the next year. Because rules, regulations, and laws are always changing, so to must your estate plan. Without the legal background necessary, you may never realize that your estate plan needs to be updated. This could mean that your business gets passed down to the wrong person or the beneficiaries you want to get certain things may never get them. Your Great Falls estate planning lawyer will be able to help you update your estate plan when necessary.

- They can guide you through probate. Many people do not stop to consider how probate will affect their estate plan or those who are named as beneficiaries. Probate can turn into a long, ugly process and may even mean that a court decides where certain assets go if they are not named properly in your estate plan. A lawyer can help you understand the probate process and can structure your estate plan so that your assets are protected and so that you can avoid probate.

- Your estate plan may change as your family changes. Family changes are inevitable, whether these changes are good or bad. You may get a divorce–or two–or you may marry the love of your life and have children. Whatever your situation is, your lawyer can help you update your estate plan so that the right people are named and things like your life insurance or retirement accounts don’t have former spouses on them. This can complicate things and can make your estate plan difficult to work with if you pass away and you never ended up updating your documents.

Don’t leave things to chance when you are working on your estate plan. Instead, reach out to a trusted Great Falls estate planning lawyer from Silverman Law Office, PLLC when you are ready to move forward.

Estate Planning Infographic

Great Falls Estate Planning Lawyer FAQs

Estate planning is a critical aspect of financial management that ensures an individual’s assets are distributed according to their wishes upon their passing. This process involves drafting documents like wills and trusts to outline the distribution of assets, care for minors, and even directives for personal care if one becomes incapacitated. An experienced Great Falls, MT estate planning lawyer from Silverman Law Office, PLLC can provide invaluable guidance to navigate the complexities of estate laws, ensuring that the plan aligns with legal requirements while reflecting the individual’s desires.

Understanding Asset Distribution Through Estate Planning

When considering the distribution of assets, many wonder what items can be included in their estate plan. Essentially, most types of assets can be incorporated into a will, from tangible property to digital assets. This includes real estate, bank accounts, investments, personal property, and even sentimental items. A detailed estate plan can help minimize potential disputes among heirs and ensure that specific legacies are preserved as intended. Continue reading to discover some of the most frequently asked questions about what can be included in a will.

Can I Include My Home And Other Real Estate In My Will?

Yes, real estate is one of the most common assets included in wills. Whether it’s a primary residence, vacation home, or investment property, specifying who will inherit these assets can prevent future disputes and complications in the estate distribution process.

What About My Bank Accounts And Investments?

Bank accounts, stocks, bonds, and other investment vehicles can also be specified in a will. It’s important to provide clear instructions on how these assets should be handled, whether they are to be transferred to specific individuals or liquidated to contribute to the estate’s overall value.

How Do I Ensure My Personal Belongings Are Distributed As I Wish?

Personal belongings, such as jewelry, art, collectibles, and other items of sentimental or monetary value, can be included in a will with detailed instructions for their distribution. This ensures that heirlooms and personal items are passed on according to your wishes.

Can I Include Provisions For My Children In My Will?

Absolutely. A will is a crucial document for appointing guardians for minor children in the event of the parents’ untimely demise. It allows parents to ensure their children are cared for by trusted individuals and can also include instructions for financial support and education funding. This is a crucial thing to speak with a Great Falls estate planning lawyer about, as your children are the most important people to look out for.

Reach Out Today

Estate planning is more than just preparing for the unforeseen; it’s about providing for loved ones and ensuring that one’s legacy is honored. An experienced Great Falls estate planning lawyer from Silverman Law Office, PLLCl can offer the expertise needed to navigate these decisions, ensuring that every aspect of an estate plan is legally sound and aligns with the individual’s wishes. If you have yet to begin this vital process or have questions about updating an existing plan, now is the time to take action. Reach out for a consultation to explore how your assets, including real estate, investments, personal belongings, and provisions for children, can be effectively managed and protected through comprehensive estate planning. Ensuring peace of mind for you and your loved ones begins with a well-crafted estate plan.