Your Dedicated Probate Attorneys

If you are in need of assistance with understanding and navigating the process of probate, our Kalispell, MT probate lawyers can help you. Probate is the process of reviewing and verifying the assets and will of the deceased, converting them into an estate, and monitoring their distribution. While mourning the loss of a friend or family member, the complex process of probate can be particularly difficult.

Our team can help you manage all of the legal requirements so that you can focus on your personal needs and responsibilities. For more information on how we can assist you and to discuss your specific probate case, contact our team at Silverman Law Office, PLLC today to schedule a consultation.

The Probate Process

Probate involves a series of steps and processes in order to validate the will and estate of the deceased and ensure that the distribution of assets and property is carried out according to the wishes expressed in the will and in a legal and fair manner. This process includes verifying the will and estate plan, appointing a personal representative for the estate, identifying and evaluating the estate’s assets and property, paying any remaining taxes and debts, and distributing the assets and property of the estate according to the wishes of the deceased and the law.

This process involves lots of paperwork, filing of information, and potential court appearances for the beneficiaries of the deceased’s will. Our Kalispell probate attorneys can take this work on your behalf and ensure that all requirements of the court are met correctly and efficiently by all necessary deadlines. Delays and disputes can derail the probate process and only add more stress and hardship to those mourning the loss of a loved one. Consulting with a probate lawyer prior to beginning the probate process helps ensure that delays and mistakes are avoided and that any potential disputes are quickly dispelled or resolved.

Situations Where There Is No Will

If the deceased has passed without leaving a valid will, their estate will be distributed by the probate court according to the laws of the state. In Montana, these laws include a system of dividing assets and property according to the beneficiary’s relationship to the deceased. These beneficiaries can include spouses, children, grandchildren, parents, and more. The exact division of the estate depends on the marriage status, presence of children, and more factors. Consulting with our Montana probate lawyers is the best way to understand what the law dictates in your specific case.

The Importance Of Professional Representation

The probate process can be a complicated one, and any missteps can lead to long delays or other consequences for beneficiaries. Consulting with an experienced lawyer is the best way to ensure that the probate process goes as smoothly as possible. Our team is here to ensure that the wishes of the deceased and your interests are protected throughout the process. For more information on how we can assist you, contact the Silverman Law Office, PLLC today.

Estate Planning Tips To Simplify Probate

Estate planning is an essential step in making sure that your assets are distributed according to your wishes after your passing. One significant aspect of estate planning is simplifying the probate process. Probate can be time-consuming, costly, and emotionally draining for your loved ones. By taking proactive steps now, you can streamline the probate process and provide your family with a smoother experience. Here are some effective estate planning tips to simplify probate.

Create A Comprehensive Will

The foundation of any estate plan is a well-drafted will. A comprehensive will outlines how your assets should be distributed, names an executor to manage your estate, and can include guardianship provisions for minor children. Without a will, your estate will be subject to intestate succession laws, which can complicate and prolong the probate process. Make sure your will is clear, up-to-date, and legally valid by consulting with an experienced estate planning lawyer.

Consider A Revocable Living Trust

A revocable living trust is a powerful tool for avoiding probate altogether. When you create a living trust, you transfer ownership of your assets to the trust. As the trustee, you retain control over the assets during your lifetime and can revoke or amend the trust as needed. Upon your death, the successor trustee you appointed will distribute the assets according to the trust’s terms, bypassing probate.

Designate Beneficiaries For Financial Accounts

Many financial accounts, such as life insurance policies, retirement accounts, and bank accounts, allow you to designate beneficiaries. Upon your death, these assets can be transferred directly to the named beneficiaries without going through probate. Regularly review and update beneficiary designations to ensure they align with your current wishes. This simple step can significantly reduce the number of assets subject to probate.

Joint Ownership Of Property

Owning property jointly with rights of survivorship is another effective way to avoid probate. When one owner passes away, the property automatically transfers to the surviving owner without the need for probate. Common forms of joint ownership include joint tenancy and tenancy by the entirety for married couples. Ensure the title to the property is properly recorded to reflect joint ownership.

Utilize Payable-on-Death And Transfer-on-Death Designations

Similar to beneficiary designations, payable-on-death (POD) and transfer-on-death (TOD) designations allow you to name individuals to receive specific assets upon your death. POD designations are commonly used for bank accounts, while TOD designations are used for securities and real estate in some states. These designations enable the assets to bypass probate and go directly to the named individuals.

Keep An Updated Inventory Of Assets

Maintaining an updated inventory of your assets can simplify the probate process for your executor. Include detailed information about bank accounts, investment accounts, real estate, personal property, and any other significant assets. Providing your executor with a clear understanding of your estate can expedite the administration process and reduce the likelihood of overlooked assets.

Simplifying the probate process is a crucial aspect of effective estate planning. By creating a comprehensive will, considering a revocable living trust, designating beneficiaries, utilizing joint ownership and TOD/POD designations, maintaining an updated asset inventory, and regularly reviewing your estate plan, you can provide your loved ones with a smoother, less stressful experience. Consulting with a Kalispell estate planning lawyer can help ensure that your plan is legally sound and tailored to your specific needs.

The Benefits Of Hiring A Probate Lawyer To Handle Complex Estates

A complex estate might involve significant assets, multiple properties, business interests, or intricate family dynamics. The probate process for such an estate can be challenging, requiring extensive legal knowledge, meticulous attention to detail, and careful navigation of various legal and financial hurdles. Hiring our Montana probate lawyer to handle a complex estate offers numerous benefits:

Skilled Legal Guidance

Probate laws are complex and vary from state to state. Understanding these laws is crucial to ensuring that the estate is handled correctly and in compliance with all legal requirements. A probate lawyer has the knowledge and experience to interpret the law, apply it to the specific circumstances of the estate, and guide you through each step of the process. This expertise is particularly important in complex estates, where the stakes are higher and the potential for legal disputes is greater.

Efficient Management Of The Probate Process

The probate process involves numerous steps, including filing the will with the court, notifying creditors, inventorying and valuing assets, paying debts and taxes, and distributing the remaining assets to beneficiaries. Each of these steps must be completed accurately and in a timely manner to avoid delays and complications. In a complex estate, these tasks can be overwhelming, especially for someone who is unfamiliar with the probate process. A probate lawyer can efficiently manage all aspects of the process, ensuring that everything is done correctly and on time, which helps to expedite the probate process and reduce stress for the executor and beneficiaries.

Accurate Valuation And Distribution Of Assets

Complex estates often include assets that are difficult to value, such as businesses, investments, and real estate. A probate lawyer can work with appraisers, accountants, and other professionals to ensure that all assets are properly valued. Additionally, a lawyer can help navigate any disputes that arise among beneficiaries, ensuring that the distribution of assets is fair and in accordance with the law.

Handling Disputes And Litigation

Complex estates are more likely to involve disputes, whether it’s a disagreement among beneficiaries, a challenge to the validity of the will, or a claim by a creditor. These disputes can lead to costly and time-consuming litigation if not handled properly. A probate lawyer can help prevent disputes by ensuring that the probate process is carried out correctly and transparently. If disputes do arise, a lawyer can represent the estate in court, working to resolve the issues quickly and efficiently while protecting the interests of the estate and its beneficiaries.

Handling a complex estate through probate can be an overwhelming task, fraught with legal, financial, and emotional challenges. Hiring a Kalispell probate lawyer from Silverman Law Office, PLLC to manage the process offers numerous benefits, including expert legal guidance, efficient management of the probate process, accurate valuation and distribution of assets, handling disputes and litigation, and tax planning and compliance.

Kalispell Probate Infographic

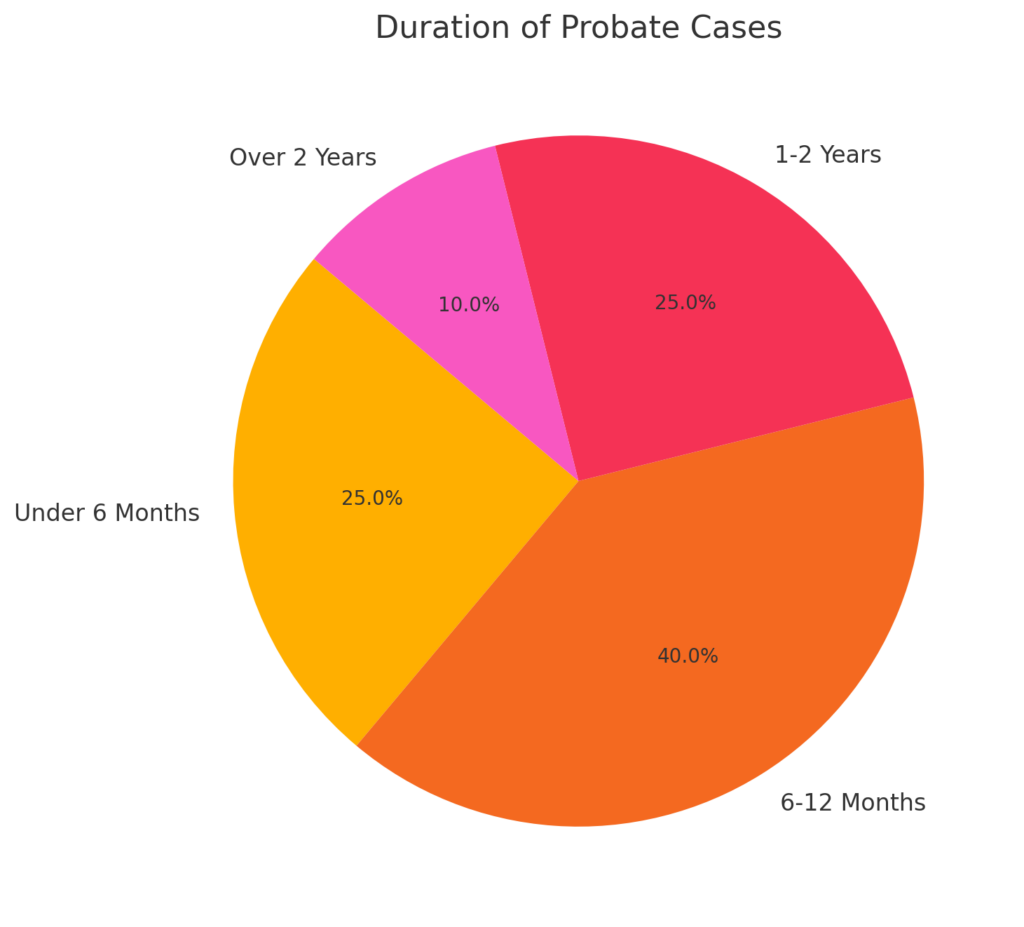

Kalispell Probate Statistics

According to national statistics, only 33 percent of Americans have an estate plan in place. Unfortunately, without a solid estate plan, many estates end up in probate, resulting in costs of more than $2 billion. Not only is probate expensive, but it can also take years for any issues to be resolved, leaving beneficiaries without the funds that the decedent had planned for them to have.

Don’t take the risk that your estate will be eaten up in legal fees and court battles. Call our office today to speak with a Kalispell probate lawyer and find out how your family’s future can be protected when you are no longer here.

Kalispell Probate FAQs

What Is A Probate Lawyer?

We assist clients in navigating the legal process that occurs after someone passes away, called probate. Our primary role is to help executors or beneficiaries settle the estate of the deceased by managing assets, paying debts, and distributing inheritances. Ultimately, probate lawyers ensure that the legal process follows the state’s probate laws and the wishes of the deceased, as outlined in their will, if one exists.

What Does A Probate Lawyer Do?

We handle various tasks during the probate process, including:

- Filing the necessary court documents to open the estate.

- Identifying and managing the deceased’s assets.

- Paying any outstanding debts, taxes, or liabilities.

- Distributing assets to the heirs or beneficiaries according to the will or state law.

- Resolving any disputes that may arise between beneficiaries or creditors.

- Closing the estate once all matters have been settled.

Do I Need A Probate Lawyer If There Is A Will?

Even if the deceased had a valid will, hiring a probate lawyer can still be beneficial. A will simplifies the probate process by providing clear instructions for asset distribution, but legal complexities may still arise. For example, disputes among heirs, creditors claiming against the estate, or property title issues may require legal expertise. A probate lawyer ensures the process proceeds smoothly, adhering to state laws and the terms of the will.

Can A Probate Lawyer Help If There Is No Will?

Yes, we are especially valuable when there is no will (intestate). In these cases, the probate process follows state intestacy laws, which determine how the deceased’s assets are distributed among heirs. A probate lawyer helps the appointed administrator gather and distribute assets according to the law and ensures the process is managed efficiently, even without specific instructions from the deceased.

How Long Does The Probate Process Take?

The length of the probate process depends on the complexity of the estate, the number of creditors or beneficiaries involved, and whether disputes arise. Simple probate cases may be resolved within six months to a year. However, larger estates or those with legal challenges could take longer, sometimes several years. A probate lawyer helps expedite the process by managing all legal requirements and ensuring deadlines are met.

How Much Does A Probate Lawyer Cost?

Probate lawyer fees vary depending on the estate’s complexity, the lawyer’s experience, and the region. Many probate lawyers charge by the hour, while others may charge a flat fee or a percentage of the estate’s value. It’s important to discuss fees upfront to ensure you understand the cost structure. In some cases, probate lawyers are paid out of the estate’s assets, not directly by the executor or beneficiaries.

What Happens If There Is A Dispute During Probate?

Disputes are common during probate and may arise over the validity of the will, asset distribution, or debt claims. We can mediate these disputes or represent their client in court if necessary. By providing legal advice and advocacy, a probate lawyer helps resolve conflicts fairly and in accordance with state law.

Kalispell Probate Glossary

Our Kalispell probate lawyers are here to assist families and individuals in managing the legal process that follows the loss of a loved one. The probate process involves various terms and legal definitions that can be unfamiliar, but understanding them is crucial for settling an estate. Below, we’ve explained some common probate-related terms to help clarify the process.

Intestate

When someone dies without a valid will, they are said to have died intestate. This means that Montana state laws determine how the deceased person’s assets are distributed among their surviving relatives. The court looks to the state’s intestacy rules to decide who inherits the property, usually starting with the closest living relatives such as a spouse or children. If no direct relatives can be found, more distant relatives may receive portions of the estate. Without a will to provide specific instructions, the estate is handled according to legal guidelines that might not align with the deceased person’s wishes.

Personal Representative

The term “personal representative” refers to the individual appointed by the court to administer the deceased person’s estate. This role is essential, as the personal representative takes on significant responsibilities. These include gathering and managing the estate’s assets, paying any outstanding debts, filing necessary paperwork, and distributing the remaining assets to the beneficiaries as outlined in the will. If there is no will, the personal representative follows Montana’s intestacy laws to distribute the estate. The person appointed can either be someone designated in the will or, if no one is named, a suitable person chosen by the court.

Revocable Living Trust

A revocable living trust is a legal tool that allows individuals to place their assets into a trust while still retaining control over them during their lifetime. The primary benefit of this arrangement is that it allows assets to pass to beneficiaries without the need for probate, which can be a time-consuming and costly process. The person who creates the trust (the grantor) can modify or even dissolve the trust at any point while they are alive. Upon their death, the assets held in the trust are distributed directly to the named beneficiaries, streamlining the transfer process. This arrangement offers flexibility and can simplify the handling of an estate.

Payable On Death Designation

A payable-on-death (POD) designation is an effective way to ensure that funds in certain financial accounts transfer directly to a named beneficiary upon the account holder’s death. This designation bypasses the probate process entirely, allowing for a quicker and more straightforward transfer of assets. Typically used for bank accounts or certificates of deposit, the POD designation allows the account holder to control their assets during their lifetime and automatically transfer them to the beneficiary upon death. It’s a simple way to handle the distribution of liquid assets without involving the probate court.

Executor

An executor is the person named in a will to carry out its instructions after the will-maker’s death. The executor is responsible for managing the estate, which includes collecting assets, paying off debts, handling taxes, and ensuring that the beneficiaries receive what the will specifies. In cases where a will exists, the executor has a duty to follow its terms while complying with Montana state laws. If no executor is named or willing to serve, the court may appoint a personal representative to assume these responsibilities.

Contact Our Kalispell Probate Lawyer Today

At Silverman Law Office, PLLC, we are dedicated to supporting you through every step of the probate process, whether you are handling an estate with or without a will. Our client-recommended team is here to help you understand your options and guide you through the required legal steps.

If you need assistance with probate matters, please reach out to us for a consultation. We are ready to provide the support you need in settling your loved one’s estate efficiently and respectfully.