Your Guide Through The Estate Planning Process

When creating a plan that clearly outlines your wishes, your first call should be to our Bozeman, MT estate planning lawyer. We have seen firsthand the devastation that can result when a person does not take the time to develop an estate plan. Be aware; an estate plan is more than a will. It is a series of documents that encapsulate every aspect of your specific situation. If there is a lack of a proper plan regarding such aspects, family members could feel like they were cheated, they may end up questioning why one family member got more money than the other, and more. There are several do-it-yourself options available on the market today. However, they can pose a significant risk. By choosing the estate planning services available at Silverman Law Office, PLLC you can strategize and map out your wishes in a way that leaves nothing up for discussion when you are no longer able to make decisions on your own. Contact our firm today to schedule a consultation with a legal team who cares about you and your future.

An Estate Plan Is More Than A Will

Estate planning is critical. There are many reasons for this. Not only do you have the ability to develop a clear plan, but you also can retain control over what happens in the future. It’s not uncommon for estate plans and wills to be used interchangeably. However, we want you to know that the two are not the same. A will is a document within the estate plan that outlines how you would like your assets and property distributed. An estate plan is more than that; it is a series of documents that includes:

- Letter of Intent

- The Last Will and Testament

- Beneficiary Designations

- Living Will

- Power of Attorney

- Medical Directives

- A Plan for Your Children

- Life Insurance Policy

- Retirement Accounts

- Bank Accounts

- + More

Our Bozeman estate planning attorney can provide essential guidance in making these critical decisions by listening to your needs and strategizing the most appropriate way to develop an estate plan that protects your interests. Moreover, there are also questions that our Bozeman estate planning attorney would ask that would aid in pertaining and focusing on the case at hand. Some examples that our lawyer would ask would be as follows.

- What kind of estate planning are you looking to implement?

- How much do you plan on giving away?

- What do you plan on giving away?

- How will financial aspects be involved with the estate planning work that you want to carry out?

- Will you be giving estate aspects away to friends and relatives as well?

These are some aspects that are important to take into consideration.

DIY Estate Plan Risks

There are a variety of reasons that one might choose to create their estate plan with an online, DIY estate planning tool. A number of these on the market promise to assist in developing an estate plan at ease and at a much lower cost. We want to caution you at pursuing this route. While developing an estate plan can seem like a straightforward process, an estate planning tool will not consider your specific situation. Not only could you risk your will being invalidated in probate, but certain state tax considerations may not be taken into account. The last thing that any person wants is to leave their loved ones to deal with the challenges that come with a DIY estate plan. Make sure that your wishes are properly carried out, your heirs retain as much wealth as possible, and complications are mitigated with the assistance of our estate planning team.

Why People Create Estate Plans

Despite what you may think, estate planning is not just for the wealthy. Most people have something that they want to leave behind for someone else after they have passed away. Of course, taking on the task of planning for a time after your death is not something most people want to think about, however, consider the impacts that not writing an estate plan can have on your friends and family. For instance, if you die without a will, then your estate will go through the process of probate and the court will distribute assets based on state intestacy laws. So basically, the court is unlikely to consider family dynamics and other nuances when making their decisions, which can cause further stress on grieving loved ones who know what the deceased would have wanted.

Listing Tangible Assets

Assets that make up a person’s estate include things such as vehicles, stocks, artwork, pensions, life insurance, boats, houses, other properties, debts, and more. Those who feel overwhelmed at the prospect of writing their estate plan can begin by just taking a look around their home. Are there cars in the garage? Is there art hanging on the walls? Are there collections displayed? Are there sentimental items that may not have much value, but are meaningful to the heart? Tangible assets include anything that you own, whether they are of high value or not.

Choosing An Executor You Trust

An executor is a representative you’ve chosen to oversee your assets. This person should be someone that you trust to follow the instructions in your estate plan and is able to perform other duties such as getting belongings appraised, speaking with beneficiaries, paying creditors outstanding debts from the estate, and more. The individual you choose does not have to be a legal professional or someone with a legal background. But as our Bozeman planning estate lawyers may advise, you may want to pick someone that is willing to take on this role in the future and knows how to ask for help when they need it. Someone who will always make choices in the best interest of the life you left behind and your legacy is the right person to appoint as your estate plan executor.

Remember Why You Are Writing An Estate Plan

The main takeaways for estate planning are that by establishing one, you are leaving behind instructions for how you want your assets to be distributed, managed, and preserved after your passing, or if you were to become unable to make sound decisions for yourself due to incapacitation. The process of estate planning includes writing a will, setting up irrevocable and revocable trusts, making charitable donations, naming beneficiaries, appointing executor, setting up funeral arrangements, and more. If you need help with this task, consider contacting our Bozeman estate planning lawyer today.

Types Of Estate Planning Services Our Attorney Offers

Planning for the future is one of the most important steps you can take to protect your loved ones and preserve your assets. Estate planning is not just about distributing property after death—it is about maintaining control, minimizing conflict, and preparing for life’s unexpected events. Our attorney offers a comprehensive range of estate planning services designed to provide clarity and long-term security.

Planning for the future is one of the most important steps you can take to protect your loved ones and preserve your assets. Estate planning is not just about distributing property after death—it is about maintaining control, minimizing conflict, and preparing for life’s unexpected events. Our attorney offers a comprehensive range of estate planning services designed to provide clarity and long-term security.

Below are the primary types of estate planning services our Bozeman estate planning attorney provides.

Last Will And Testament

A last will and testament is the foundation of many estate plans. This document outlines how your assets will be distributed after your passing and allows you to name an executor to manage your estate.

A will also enables parents of minor children to designate a guardian. Without a valid will, state intestacy laws determine how your assets are divided, which may not reflect your wishes.

Our attorney drafts customized wills that clearly express your intentions while ensuring compliance with state legal requirements.

Revocable Living Trusts

A revocable living trust allows you to transfer assets into a trust during your lifetime while maintaining control over them. Upon your passing, assets held in the trust can be distributed to beneficiaries without going through probate.

Living trusts offer several advantages, including privacy, faster asset distribution, and continuity of management if you become incapacitated. Our attorney evaluates whether a trust aligns with your financial goals and family structure.

Irrevocable Trusts

Irrevocable trusts provide additional asset protection and potential tax planning benefits. Once established, these trusts generally cannot be modified without beneficiary consent.

Irrevocable trusts may help protect assets from creditors, reduce estate tax liability, and preserve wealth for future generations. We carefully design these trusts to meet long-term planning objectives while complying with applicable laws.

Powers Of Attorney

Incapacity planning is a crucial component of any estate plan. A durable financial power of attorney allows you to appoint a trusted individual to manage your financial affairs if you are unable to do so.

Without this document, loved ones may need to seek court approval to handle your finances. Our Bozeman attorney ensures that your power of attorney clearly defines authority and safeguards your interests.

Healthcare Directives And Living Wills

Healthcare directives allow you to outline your medical treatment preferences in the event you cannot communicate your wishes. A healthcare power of attorney designates someone to make medical decisions on your behalf.

A living will may include instructions regarding life-sustaining treatment and end-of-life care. These documents reduce uncertainty for family members and provide guidance during emotionally difficult situations.

Asset Protection Planning

Asset protection planning helps safeguard your wealth from potential creditors, lawsuits, or long-term care expenses. Depending on your circumstances, strategies may include trust structures, business entity formation, or other legal tools.

Our attorney works proactively to structure your estate in a way that minimizes risk while maintaining compliance with the law.

Estate planning is an ongoing process. Our Bozeman estate planning attorney also provides plan reviews and updates to reflect life changes such as marriage, divorce, new children, or significant financial shifts. At Silverman Law Office, PLLC, we are here to help you.

Bozeman Estate Planning Infographic

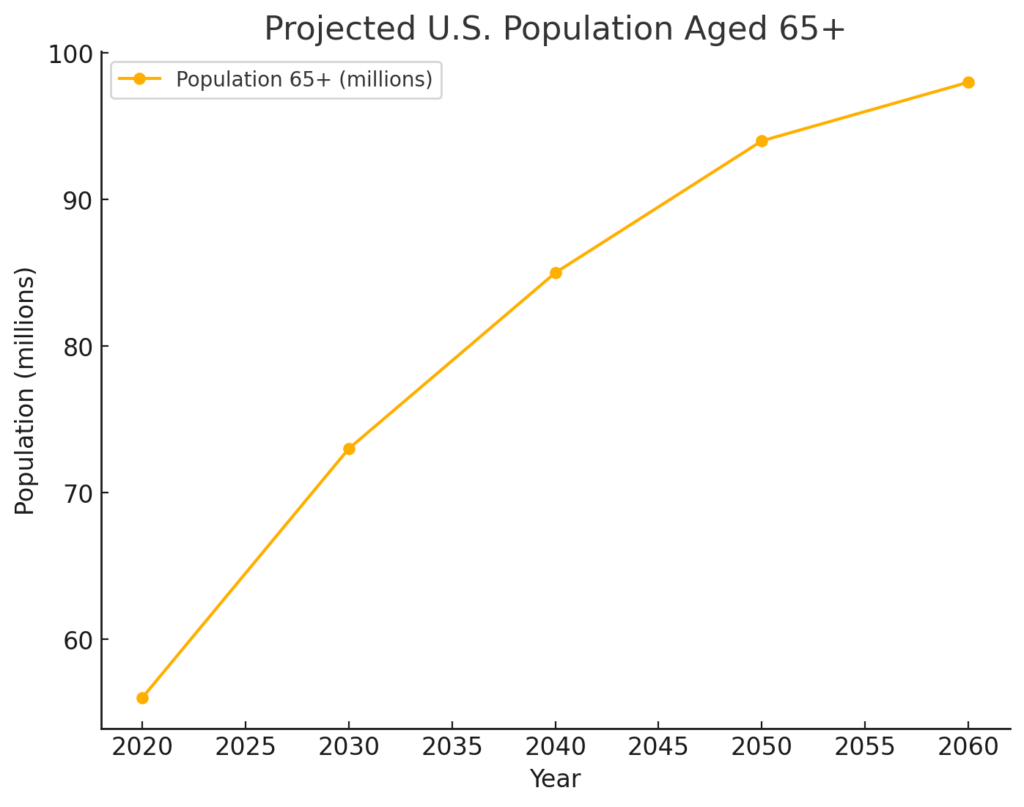

Bozeman Estate Planning Statistics

According to the U.S. Census Bureau, by the year 2060, a quarter of the U.S. population will be 65 years of age or older. The Census Bureau also predicts that the number of people in this country who are 85 years or older will triple the number right now.

However, it is important to realize that with the increased number of older Americans, there will also be a significant need for facilities to help with elder care and these facilities can effectively wipe out a person’s lifesaving because of the exorbitant fees they charge. Don’t let this happen to you. Contact our Bozeman estate planning lawyer for legal help to protect your estate.

Bozeman Estate Planning FAQs

If you have not planned for the future of your estate, it would be beneficial to contact Silverman Law Office PLLC and start the process of safeguarding your legacy today. While there can be ambiguity surrounding estate planning, we hope the following answers to commonly asked questions will help.

What Is An Estate Plan?

Estate planning is the process of distributing the estate’s assets, writing your living will, preparing medical directives, arranging funeral plans, and making sure your wants and desires are carried out. While many people believe that an estate plan and a living will are the same thing, and thus interchangeable, that assumption is false. A living will is a document within the estate plan, but the estate plan accounts for many other aspects of the estate owner’s life as a whole. These other aspects include a letter of intent, the will, beneficiary designations, power of attorney, advanced healthcare directives, a plan for children, their life insurance policy, and retirement and bank account information.

Why Should I Make An Estate Plan?

An estate plan allows you to document and instruct your wants and wishes. More than just beneficiary designations, your estate plan will ensure you are taken care of medically, and that your loved ones are looked after. There should be no questions or confusion regarding your end-of-life care, and how you wish you carry on your legacy. An estate plan is a plan for the estate owner, and those he or she cares most about.

Why Is An Attorney Essential For Estate Planning?

Estate planning attorneys will work on your behalf to make sure your estate is well taken care of, your assets distributed, and your documents are all accounted for. We understand tax considerations, and legal ramifications of estate planning, and will make sure your estate executor has everything they need to carry out your wishes. There are many decisions in the process of planning your estate for the future. Our Bozeman estate planning attorney is able to guide you through those decisions, and aid in any problems that arise.

What Is An Executor Of Your Estate?

The executor of your estate is someone the estate owner appoints to distribute their assets, communicate with their beneficiaries, hold to their medical directives and carry out their instructions with honesty and integrity. Due to the immense responsibility this role requires, it is important to select someone whom the estate trusts wholeheartedly. This person does not need experience with the law but is free to reach out to our estate planning attorney if they have any questions.

Silverman Law Office, PLLC, Bozeman Estate Planning Attorney

504 W Main St, Bozeman, MT 59715

Read more of our Google reviews and let us know how we can help you with your estate plan.

Contact Our Bozeman Estate Planning Attorney Today

No one wants to consider life when they no longer can make decisions on their own. Many believe that there will be plenty of time to develop an estate plan. While we hope that you live a long and happy life, you must put the proper planning into your estate plan. In other words, it is important to plan ahead of time. The reason why this needs to be the case is not just so that one can avoid devastation in relation to family factors. There also needs to be a strong focus on an individual being able to clearly state their specific needs with our estate planning attorney. You will want to make sure that your wishes are carried out to the fullest extent.

At Silverman Law Office, PLLC, our estate planning attorney in Bozeman, Montana, can help you develop a plan that outlines every last aspect of your estate. Call our office today and see how we can help.