Losing someone you care deeply for is challenging enough without having to deal with probate. There are legal matters that need to be taken care of after someone’s death and this can be difficult to manage alone. This is why we suggest contacting our Great Falls, MT probate lawyer for assistance. Taking proactive action can reduce the burden associated with probate. Many people write an estate plan so their estate avoids probate down the line. Beneficiaries are often grateful when probate can be prevented, as this can be a time-consuming and grueling process for those in the midst of grief. If you have questions about probate, contact our client-recommended firm Silverman Law Office, PLLC today and set up a consultation.

What Probate Lawyers Do

Probate lawyers can serve as executives or administrators of estate for their clients after a loved one passes away. This process entails distributing assets for the estate and paying the decedent’s debts. Our dedicated probate attorney can assist you with many tasks, such as filing the last will and testament, keeping track of the estate checking account, filing documents as needed by the court, obtaining date-of-death certificates and property appraisals, collecting life insurance proceeds, addressing income tax issues, managing retirement accounts, and transferring the decedent’s assets to beneficiaries, among others. Ultimately, if you have a probate related problem or need help handling a decedent’s assets and affairs, we suggest contacting our team for support.

Probate Process

The probate process can be costly and prolonged, so many people try to make arrangements prior to their passing to avoid it. Probate assets only get distributed after taxes and debts have been paid. Depending on the situation, your personal representative may have to liquidate assets to settle such obligations, which can risk planned inheritances. By devising an estate plan you can reduce the consequences of probate. Certain types of irrevocable trusts can be utilized for asset protection and limit the impact of federal estate taxes. In the state of Montana, it may also be possible to expedite a probate procedure if the estate is smaller. If you have inquiries regarding asset evaluations, probate administration, estate tax planning, estate distribution, or a contested probate, reach out to us right away.

Silverman Law Office, PLLC

At Silverman Law Office, PLLC, we understand that estate administration and probate can be a confusing process. Rest assured that our compassionate probate attorney can give you the support and insight you need at this time. The laws for probate vary by state, so we suggest speaking with a member of our team for individualized guidance. The best approach for protecting your assets from probate is by establishing a comprehensive estate plan. If you want to get started on your estate plan or need assistance regarding a probate related issue, don’t hesitate to contact our team today. We are ready to help!

Common Challenges In Probate And How A Probate Lawyer Can Help

The probate process can be fraught with challenges, particularly during an already emotional time following the loss of a loved one. Understanding the common issues that arise during probate and how our Montana probate lawyer can assist is essential for navigating this difficult period smoothly and efficiently.

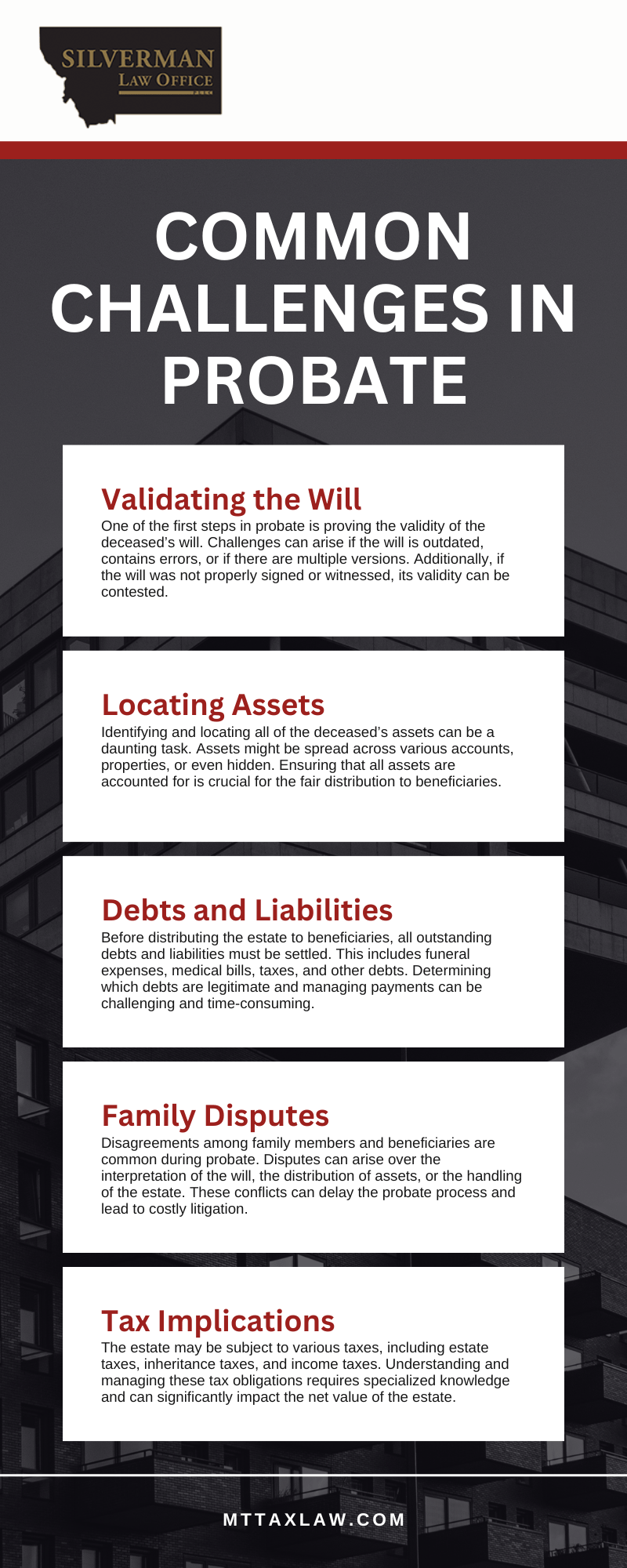

Common Challenges In Probate

- Validating the Will

- One of the first steps in probate is proving the validity of the deceased’s will. Challenges can arise if the will is outdated, contains errors, or if there are multiple versions. Additionally, if the will was not properly signed or witnessed, its validity can be contested.

- Locating Assets

- Identifying and locating all of the deceased’s assets can be a daunting task. Assets might be spread across various accounts, properties, or even hidden. Ensuring that all assets are accounted for is crucial for the fair distribution to beneficiaries.

- Debts and Liabilities

- Before distributing the estate to beneficiaries, all outstanding debts and liabilities must be settled. This includes funeral expenses, medical bills, taxes, and other debts. Determining which debts are legitimate and managing payments can be challenging and time-consuming.

- Family Disputes

- Disagreements among family members and beneficiaries are common during probate. Disputes can arise over the interpretation of the will, the distribution of assets, or the handling of the estate. These conflicts can delay the probate process and lead to costly litigation.

- Tax Implications

- The estate may be subject to various taxes, including estate taxes, inheritance taxes, and income taxes. Understanding and managing these tax obligations requires specific knowledge and can significantly impact the net value of the estate.

How A Probate Lawyer Can Help

- Validating the Will

- A probate lawyer can help ensure that the will meets all legal requirements and can represent the estate in court to validate the will if necessary. They can also advise on steps to take if the will is contested or if multiple versions exist.

- Locating and Managing Assets

- Probate lawyers have experience in conducting thorough asset searches and can help locate and inventory all assets of the deceased. They can also assist in managing and valuing these assets to ensure accurate distribution.

- Handling Debts and Liabilities

- A probate lawyer can help determine which debts are valid and prioritize their payment. They can also negotiate with creditors if necessary and make sure that all liabilities are settled before distributing the remaining assets to beneficiaries.

- Resolving Family Disputes

- Experienced probate lawyers are skilled in mediating family disputes and can offer impartial advice to resolve conflicts. If necessary, they can represent the estate in court to settle disputes through litigation.

- Navigating Tax Issues

- Probate lawyers are knowledgeable about the tax implications of an estate and can provide guidance on minimizing tax liabilities. They can prepare and file necessary tax returns and ensure compliance with all tax regulations.

The probate process involves numerous challenges that can be overwhelming without proper legal guidance. By working with a probate lawyer from Silverman Law Office, PLLC, families can facilitate a smoother probate process, minimize conflicts, and achieve a fair and efficient distribution of the estate.

Common Mistakes In Probate And How A Lawyer Can Help You Avoid Them

The probate process can be complicated and overwhelming, especially during a time of grief. Unfortunately, the many layers of probate often lead to mistakes, which can result in delays, legal disputes, and financial loss. Working with our Great Falls probate lawyer can help you avoid common pitfalls. Here are some of the most frequent mistakes made in probate and how a lawyer can assist you in avoiding them.

1. Failing To Properly Identify And Value Assets

One of the first steps in probate is identifying and valuing the deceased’s assets. This includes everything from bank accounts and real estate to personal belongings and investments. A common mistake is overlooking certain assets or incorrectly valuing them. This can lead to inaccurate estate accounting and potential disputes among heirs.

A probate lawyer has the experience to ensure that all assets are properly identified and accurately valued.

2. Misunderstanding Or Ignoring Deadlines

The probate process involves strict deadlines for filing documents, paying debts, and distributing assets. Missing these deadlines can result in penalties, legal disputes, and prolonged probate. Executors and administrators, often overwhelmed with the responsibilities, may inadvertently miss these critical dates.

Our Montana probate lawyer is well-versed in the timelines and requirements of the state’s probate process. They help you stay on track by managing deadlines, filing necessary documents on time, and ensuring that all legal obligations are met promptly.

3. Failing To Notify Creditors

One of the executor’s duties in probate is to notify creditors of the deceased’s passing so they can make claims against the estate. Failing to properly notify creditors can result in unknown debts emerging later in the process, causing delays and financial complications.

A probate lawyer can assist in ensuring that all creditors are properly notified according to state law. They can also help in negotiating and settling debts, protecting the estate’s assets from being unnecessarily depleted by creditors’ claims.

4. Distributing Assets Too Early

One of the most common and costly mistakes in probate is distributing assets to beneficiaries before all debts, taxes, and expenses have been paid. This can result in personal liability for the executor or administrator if the estate’s funds are insufficient to cover these obligations after distributions have been made.

The probate process is riddled with potential pitfalls, especially for those unfamiliar with legal procedures and obligations. Common mistakes, such as failing to properly identify assets, missing deadlines, or distributing assets too early, can lead to significant complications. However, with the guidance of a Great Falls probate lawyer from Silverman Law Office, PLLC, you can navigate this process with confidence and efficiency. We not only help you avoid costly mistakes but also advocate for the estate to be settled fairly and according to the law, providing peace of mind during a challenging time.

Great Falls Probate Infographic

Great Falls Probate Statistics

Contested probate cases, where individuals dispute the validity of a will or the distribution of an estate, are relatively uncommon. Research indicates that between approximately 5 percent of all wills are contested. Although that number may seem low, given that millions of wills are probated annually, this percentage translates to a substantial number of contested cases each year. The most common grounds for contesting a will include allegations of undue influence, lack of testamentary capacity, and failure to adhere to required formalities.

If you would like to learn more about probate and contesting wills, call a Great Falls probate lawyer to schedule a confidential consultation.

Probate FAQs

Dealing with the legal process after a loved one’s death can be overwhelming, especially when it involves navigating the probate system. Our Montana probate lawyer guides individuals through this often-complex process. Below are some frequently asked questions about working with a probate lawyer.

1. What Does A Probate Lawyer Do?

A probate lawyer assists with the legal process of administering a deceased person’s estate. This includes managing the distribution of assets, paying off debts, and ensuring that the estate is handled according to the deceased’s will or state law if there is no will. A probate lawyer’s duties include:

- Filing the will with the probate court.

- Helping the executor or administrator carry out their duties.

- Resolving disputes among beneficiaries.

- Guiding clients through the legal steps to settle the estate.

2. Do I Need A Probate Lawyer?

Hiring a probate lawyer can be beneficial in many situations. You may want to hire one if:

- The estate is large or complex. If the estate has numerous assets, businesses, or involves multiple beneficiaries, a lawyer can simplify the process.

- There’s no will. If the deceased did not leave a will, a probate lawyer can help ensure that the estate is distributed according to state laws.

- There are disputes. A probate lawyer can help resolve conflicts between beneficiaries, such as disagreements over asset distribution or the validity of the will.

3. What Is Probate?

Probate is the legal process by which a deceased person’s estate is settled. It involves proving the validity of the will, paying off debts and taxes, and distributing the remaining assets to beneficiaries. The probate court oversees this process to ensure everything is handled correctly and in compliance with the law.

4. How Long Does The Probate Process Take?

On average, probate can take anywhere from several months to over a year. Factors that can lengthen the process include:

- Estate complexity: Large estates or those with many assets can take longer to settle.

- Disputes: If there are legal challenges or conflicts among beneficiaries, the process may be delayed.

- Outstanding debts: Paying off debts or waiting for creditors to make claims can add time.

- Court delays: Some probate courts are backlogged, which can further extend the process.

A probate lawyer can help streamline this process by ensuring all documents are filed correctly and handling any legal issues that arise.

5. How Much Does A Probate Lawyer Cost?

Probate lawyer fees can vary, and they typically charge based on:

- Hourly rate: Some lawyers charge an hourly fee, which can range depending on the complexity of the case and the lawyer’s experience.

- Flat fee: For more straightforward probate cases, a lawyer may offer a flat fee.

- Percentage of the estate: In some states, probate lawyers are allowed to charge a percentage of the estate’s value as their fee.

During your initial consultation, the lawyer should provide you with a clear breakdown of their fee structure.

Probate Glossary

Probate law can involve various legal concepts that may seem complicated. Understanding these terms can help you better comprehend what our Great Falls probate lawyer does and how they can assist you. This glossary covers some of the most commonly encountered probate terms to give you a clearer picture of the processes involved.

Personal Representative

A personal representative is appointed by the court to oversee the estate of someone who has passed away. In Montana, this person may be a family member, close friend, or professional fiduciary. The personal representative’s duties include identifying and collecting the deceased’s assets, paying outstanding debts, and distributing what remains to beneficiaries according to the will or state law if no will exists. Their role is vital in ensuring that the estate is handled properly and that all necessary legal requirements are met throughout the probate process.

Estate Plan

An estate plan is not just a single document but a comprehensive strategy designed to manage an individual’s assets both during their life and after they pass away. It usually includes elements like a will, trusts, healthcare directives, and powers of attorney. The purpose of an estate plan is to provide clear instructions on how assets should be distributed, who should make decisions if the person becomes incapacitated, and how to protect wealth from probate and potential tax burdens. In Montana, a solid estate plan can help simplify the probate process and protect family members from legal disputes over the estate.

Irrevocable Trust

An irrevocable trust is a legal arrangement that, once established, generally cannot be changed or terminated. This type of trust is often used in Montana for asset protection and reducing estate taxes. Assets placed into an irrevocable trust are no longer considered the property of the person who created it, which can provide protection from creditors and reduce the taxable value of an estate. This means that those assets are typically excluded from the probate process, making it a useful tool for individuals who want to safeguard their wealth for future generations.

Contested Probate

When disagreements arise over the administration of an estate, the probate process may become contested. This often occurs when there are disputes among heirs or beneficiaries over the validity of a will, the interpretation of its terms, or the fairness of the asset distribution. These disputes can lead to litigation if they cannot be resolved through other means. A probate lawyer in Great Falls, MT, can assist in managing these disputes by representing the interests of their client, whether through negotiation or court proceedings, to reach a resolution that aligns with Montana’s probate laws.

Probate Administration

Probate administration refers to the full scope of activities involved in settling an estate after someone’s death. This includes filing the necessary paperwork with the court, proving the will (if one exists), identifying and valuing the deceased’s assets, paying off debts and taxes, and finally, distributing the remaining assets to the rightful beneficiaries. The probate administration process can be time-consuming and requires strict adherence to Montana’s probate rules and procedures. An experienced probate lawyer can guide the personal representative through this process to avoid delays and potential legal pitfalls.

Reach Out Today For Legal Support

Whether the estate is straightforward or complex, our probate lawyers provide guidance, reduce stress, and help avoid costly mistakes. If you’re facing any challenges with probate or have questions about managing an estate in Great Falls, Montana, we’re here to help. Reach out to Silverman Law Office, PLLC for compassionate and knowledgeable legal support tailored to your needs.