Helena Estate Planning Attorney

Our Helena estate planning attorney that residents trust has the knowledge and skills necessary to assist you in planning for the future. While it may be tempting to set your estate plan aside, it’s imperative that you not put yourself at risk, especially when the unexpected occurs. We can help you understand each essential element to your estate plan and ensure that nothing is left out. Get started with Silverman Law Office, PLLC, a Helena estate planning attorney you can rely on to help put your affairs in order.

Table of Contents

- Popular Myths About Estate Planning

- Questions You Should Ask Your Estate Planning Attorney

- Understanding The Difference Between Wills And Trusts

- Get In Touch With Silverman Law Office, PLLC Today

- Key Elements To Include In Your Estate Plan

- How To Know It’s Time To Update Your Estate Plan

- Estate Planning Infographic

- Estate Planning FAQs

Popular Myths About Estate Planning

You may be thinking of planning your estate but have several unanswered questions about what you need, when you should begin, and whether you even are required to have an estate plan! As a Helena estate planning attorney, we often hear from those interested in an estate plan. What we have found is that a majority of the information relayed to us is not exactly true. The following is an attempt to dispel some of the most common myths about estate planning. If you have any further questions, please consult a Helena estate planning attorney.

Estate Plans Are Only for Wealthy People

This is the most common myth about estate planning. The truth is that everyone can benefit from having some kind of estate plan. Even those who have no assets should consider tools like a medical directive and power of attorney. Without an estate plan, our Helena estate planning attorney shares that the court will have the right to decide on questions like:

- What will happen to you if you become incapacitated?

- Who will take care of you if you can no longer make decisions?

- What will happen to your minor or disabled adult children if you are incapacitated or die?

- Who will be given your assets upon your death?

- Will you be buried or cremated?

- Do you wish to donate your organs upon your death?

If you don’t plan your estate, a judge can decide on the matters above, and more, according to the laws in the state. Most people would not be comfortable knowing this, so it is crucial to plan your estate with a Helena estate planning attorney.

The State Will Get All Your Assets

In a limited number of circumstances, the state can inherit your assets. This is very rare, however. If you die without an estate plan or will, your assets will go to your living spouse if you are married. If you are not married, or a widow, your children will receive your assets. Our Helena estate planning attorney shares that when this is not applicable, your living parents, siblings, or extended family will likely inherit your belongings. Only if there are no surviving family members will the state have a chance at inheriting your assets.

An Estate Plan Can Be Done Just Once

Many people think that once an estate plan has been drafted, it can never be amended. This is not true. You can modify your estate plan as often as possible. This would be expensive and time-consuming. It also increases the risk of a dispute. As a Helena estate planning attorney might recommend, you should carefully think about everything before you draft the documents. Whenever there are life events, you should ensure your estate plan is updated to meet them as best as possible.

Estate plans can help to secure your future and that of your loved ones. They are not something to ignore, and there is never a time that you don’t need one. You cannot be too young or too old to have an estate plan. If you are ready to plan your estate, call an estate planning attorney in Helena today. Call Silverman Law Office, PLLC.

Questions You Should Ask Your Estate Planning Attorney

What Estate Planning Experience Do You Have?

When you are interviewing a potential Helena estate planning attorney, e.g., the Silverman Law Office, you need to know that the attorney has enough experience to handle your estate properly. Ask about potential attorneys’ experience in general, as well as their experience in estate law. Then, ask how long the firm has been in business and how many of the attorney and firm’s clients are estate clients.

Your goal should be to find a law firm and lawyer whose primary focus is estate planning. They need to be able to effectively create your estate plan and defend it in court against both the beneficiaries and the IRS.

How Often Will My Plan Be Reviewed?

Don’t work with a Helena estate planning attorney who does not provide periodic estate plan reviews. Every year, something in your life changes. You may pay off or increase your debts or purchase additional assets. If you retire, your assets will change as well.

You may also change your mind about your bequeathments. For example, you may get a divorce, adopt a child, get married, gain a grandchild, etc., and each of these life events may change how you want your assets distributed.

The lawyers at the Silverman Law Office should guide you about what you need to do when your life situations change. Although you want your attorney to do a periodic review of your estate, you should also be proactive and contact your estate lawyer when you experience major changes in your life.

What Types of Plans Do You Suggest?

Your Helena estate planning attorney should be well-versed in all aspects of an estate plan. As you interview your prospects, ask about their use of wills, trusts, powers of attorney and other tools.

The goal should be to reduce the tax burdens of your beneficiaries as much as possible. In addition, you may be concerned with who will make your financial and medical decisions if you are ever incapacitated. You also want your estate documents to be as clear as possible about your distribution desires so that your estate is well-insulated against lawsuits. Having a well-rounded estate plan protects you and your beneficiaries.

Understanding the Difference Between Wills and Trusts

You may know about wills and trusts already, but a Helena estate planning attorney can provide an in-depth look at these two options for planning out your future and protecting your legacy. Many people have heard of wills through the media, or from their friends and family. But when it comes time to plan out their estate, they’re usually a little lost. It’s perfectly understandable: Wills and trusts are complicated affairs to manage, and it’s always best to get in touch with a qualified attorney you can trust when it comes to creating your will or trust.

So what should you choose? There’s no right or wrong answer. Fortunately, we can explain a bit of the nuance between wills and trusts, and we can help you decide which option is best for your situation. Wills and trusts both have their pros and cons, and understanding the difference is the best way to protect your assets and the future of your family when you’re no longer there to provide for them directly.

What is a Will?

A will is a list of your assets and beneficiaries. In plain english, this means a whole list of everything you own, and the people who will be receiving these things after your death. This goes beyond just possessions like heirlooms or collections: It includes properties, investments, and even debt. The contents of your will can be divided up amongst your family, friends, and anyone else you’d like to include. Unfortunately, wills aren’t as straightforward as they sound when it comes time to actually distribute what you’ve left behind.

If you leave behind a will, it means your beneficiaries will have to deal with probate court. This is a special court that handles the distribution of all your assets, and it can be a challenging, drawn-out, and frustrating affair for everyone involved. Your family members might fight over the contents of your will, and they might try to cut each other out of your will altogether. Probate means drama, but fortunately a Helena estate planning attorney can help you protect your family from this legal battle altogether. Read on to learn about trusts.

What is a Trust?

Trusts, also known as “living trusts” are similar to wills, but very different when it comes to execution. When you create a trust, much like a will, you’re creating a list of your assets and your beneficiaries. However, when you create a trust, you’re naming a third party to handle your estate after your death. This means no probate, and no chance for any legal battle over your assets when you’re no longer there to keep those estranged family members from causing problems for everyone else.

Trusts are a great way to keep things straightforward for your family members after your death, but there is a downside. Trusts need to be actively managed throughout your lifetime, and they can be complicated (and expensive) to set up in the first place. Fortunately, with the help of a Helena estate planning attorney, creating a trust can be much easier than you’d expect.

Get in Touch with Silverman Law Office, PLLC Today

At Silverman Law Office, PLLC, we understand how important it can be to ensure a stable and safe future for your loved ones. Get in touch with us today to plan out your will or trust, and see how a Helena estate planning attorney can help.

What Are Your Fees?

Ask your prospective estate attorneys about their fee schedules. For example, do they charge by the hour or by the process? Also, how much do they charge for different services, such as research, contracts, trust setup, will creation, etc.? If other legal professionals, such as paralegals, work on your file, the fee schedule may change, so find out who will work on your estate and what fees they charge. Ask how much you will be charged for periodic reviews as well. You don’t want to be surprised by the size and timing of your legal bills, so get the details upfront.

Don’t Put Yourself and Your Family at Risk

Estate plans can be easy to push to the back of your mind. After all, there will be plenty of time to get it done. While we hope that you live a long and fulfilled life, unfortunately, the unexpected can occur. Don’t leave your family vulnerable to the challenges that could come should something happen to you without a plan in place. Call our Helena estate planning attorney so that we can help you. Risks for not having an estate plan include:

- You will not have the ability to choose how your assets are distributed, and to whom, the courts will assign an executor to make this decision for you

- There is a higher likelihood for familial conflict when there is no estate plan in place, as it’s likely that family members will have differing views over how your affairs should be handled

- Our Helena estate planning attorney shares that you risk not having a guardian appointed to care for children under the age of 18

- Your loved ones will not have guidance from you regarding end-of-life care if you are suddenly incapacitated

When someone passes away, the family is left to weather the storm, managing their loved one’s affairs and grieving their passing. Without a plan in place, our Helena estate planning attorney has seen first hand the challenges your loved ones may be left to contend with. Mitigate the chance for complications by contacting the Silverman Law Office, PLLC.

Get Started with Silverman Law Office, PLLC

While it can be easy to put off creating your estate plan for another day, the time to get started is now. Give yourself the peace of mind both you and your loved ones deserve by contacting our Helena estate planning attorney. Our team will make the process of developing your estate plan as easy and pain-free as possible. You can expect that our attorney will:

- Reduce estate taxes so that your loved ones can retain as much of your wealth as possible

- If you become incapacitated and unable to make decisions on your own, you will need to have someone identified as power of attorney and a medical health care directive in place.

- Our Helena estate planning attorney can provide insight into estate planning law when making critical decisions pertaining to your estate

- Have the most up to date knowledge regarding estate planning laws in Montana

- Gather as much information from you as possible to develop an estate plan that far exceeds your expectations

- Continue to update your estate plan when necessary, or every 3-5 years

Don’t put off the creation of your estate plan for another day; put your affairs in order so that your family will have a clear picture of your wishes when the time comes. For more information, please schedule an appointment today with our Helena estate planning attorney.

Silverman Law Office, PLLC, can provide Montana residents with the guidance they need to develop their estate plan. Give yourself the ability to make critical decisions over how your assets will be managed, and your affairs settled after you are gone. To get started, call our Helena estate planning attorney at Silverman Law Office, PLLC.

Key Elements to Include in Your Estate Plan

Developing an estate plan includes far more than just a will. Our Helena estate planning attorney shares that an estate plan will include a variety of necessary elements. Be aware that an estate plan is more than just a plan for after you have passed away, it can also include critical decisions for while you are still alive. At Silverman Law Office, PLLC, we can help you develop a plan that leaves nothing to the imagination. We can provide you with the guidance needed to ensure that your estate plan is comprehensive and that you have shared your wishes with those close to you.

The Last Will and Testament

Our Helena estate planning attorney will share with you that the last will and testament outlines your final wishes in the event of your passing. A will outlines your assets and how they will be distributed. Your will includes critical decisions such as beneficiaries, guardians for your children, and how your debts will be paid.

Medical Directives

A healthcare directive or living will, outlines your wishes for end of life treatment. If you become ill or incapacitated, you will want to make sure that your loved ones have a clear picture of your final wishes. Our Helena estate planning attorney knows that no one wants to face a tragic event. However, you should always make sure that you are prepared for the unexpected.

Power of Attorney

You will need to appoint someone to be your healthcare power of attorney and financial power of attorney. The healthcare power of attorney is responsible for making decisions regarding your healthcare. A financial power of attorney is someone who is appointed to make financial decisions if you are unable to. The appointed party will be responsible for stepping in to manage your financial affairs, such as bill paying and critical financial decisions.

Trust

Our Helena estate planning attorney may recommend that you consider creating a trust. You can develop a trust whether you are living or have passed away. You may have the ability to place assets into a trust for beneficiaries. A trust will allow you to keep some of your assets out of the probate process and develop specific instructions for how assets are distributed to heirs.

Talking to Your Family

Once you have developed your estate plan, you must speak with key family members to share your wishes. While this will be a difficult conversation to have, it is critical for many reasons. Our Helena, Montana estate planning attorney, shares that you must have these conversations ahead of time. Speaking with your family can mitigate the risk of complications down the road. Here are some tips for talking with your family about your estate plan:

- Pick the right time

- Speak with your adult children

- Share with them who the executor is

- Tell them where they can find all necessary documents

Our Helena estate planning attorney knows that the thought of putting together your estate plan can seem like a cumbersome process. At Silverman Law Office, PLLC, we can assist you in making the process as straightforward and stress-free as possible. We can take the time to listen to your needs and ensure that an estate plan is created that keeps your best interests at heart. Don’t drag your feet any longer; contact our Helena estate planning attorney to get started.

How to Know It’s Time to Update Your Estate Plan

Too many people believe that they can create an estate plan and then just forget about it. However, it is necessary for most people to update their estate plan multiple times throughout their lives. Here are a few good reasons to update your estate plan.

- You have acquired assets. It is normal for people to acquire certain assets throughout their lives. Whether it is a new summer home or an inheritance from a relative, it is time to give your estate plan another look. Changes in the value of your assets can impact distributions in an estate plan.

- The executor can no longer perform the job. The executor is responsible for paying your debts and distributing assets to your heirs after you are gone. However, circumstances can change over time and your current executor may not be able to serve in the role anymore. For example, your executor may have fallen ill or moved out of state. In this situation, you should contact your Helena estate planning attorney and revise your estate plan.

- You got married or divorced. Changing your estate plan is a must when you get married or divorced. When you get divorced, you want to remove your ex-spouse from your estate plan. On the other hand, when you marry someone else, you want to include your new spouse in your plan.

- You had a child. If you adopt or have a child of your own, it’s time to reassess your estate plan. You want to make sure they are provided for should you die suddenly. It’s also important to appoint a guardian for your minor children in your plan.

- You moved to another state. If you recently moved to a new state, you’ll want to take another look at your estate plan. Estate planning laws can differ from state to state and you want to make sure your estate plan reflects your new state’s laws. You will also likely need to appoint a new executor who lives in your new state.

- Your spouse died. Many times, married couples leave most of their property to one another. As such, if your spouse dies, it is necessary to update your estate plan as soon as possible and designate who you want to receive those assets.

There comes a time for many families when it is necessary for someone to become the legal guardian of an adult relative. In order to become a legal guardian, a Montana court must appoint you through a guardianship proceeding. Typically, adult guardianship becomes necessary for individuals who are unable to make or communicate responsible personal or financial choices as a result of mental illness, deterioration or disability, physical incapacity, or impairment as a result of excessive use of intoxicants or drugs. One way to address issues like this before they occur is to work with a Helena estate planning attorney.

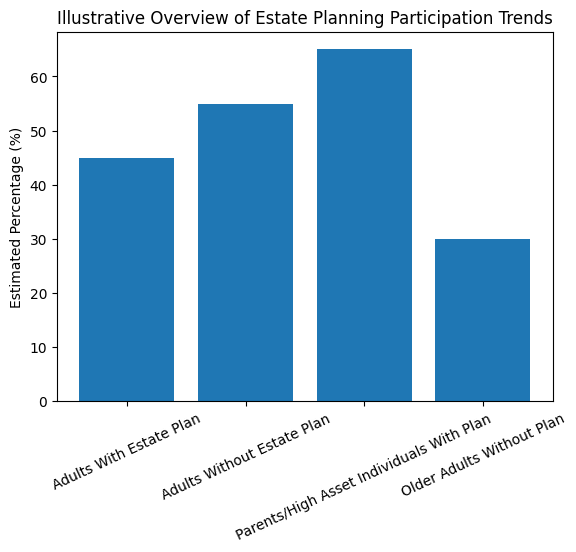

Estate Planning Infographic

Helena Estate Planning Statistics

According to national statistics, estate planning in the United States has continued to decrease. A recent study found a 6 percent overall decline, with an alarming 16 percent decline in people in a lower-income bracket. There have been no changes in the 18-34 age group.

Don’t leave your family struggling when you are no longer here. Call our office to speak with a Helena estate planning lawyer to find out how we can help.

Helena Estate Planning Statistics

Estate planning remains an essential financial planning tool, yet many adults do not complete basic documents that protect their assets and wishes. According to the Employee Benefit Research Institute (EBRI) and supported by federal survey data, a significant share of Americans lack a will, trust, or advance directive — even among older age groups for whom planning is most critical. Government-linked research and survey reports show that individuals with children or substantial assets are more likely to have formal estate plans, while many others rely on informal arrangements or delay planning altogether.

These trends highlight ongoing gaps in public awareness and uptake of estate planning tools, including wills, powers of attorney, and healthcare directives. Such statistics are used by policymakers, financial planners, and legal professionals to understand barriers to planning and develop education efforts aimed at increasing participation. Estate planning prevalence rates underscore the importance of making legal arrangements well before a crisis occurs.

Estate Planning FAQs

What kind of documentation is needed to file for adult guardianship?

In order to become a guardian over another adult, you first must obtain written documentation from the individual’s doctor that he or she suffers from one of the conditions that make guardianship appropriate. You also must decide what type of guardianship you are seeking. For instance, you can seek a limited guardianship that covers only certain aspects of an individual’s life, such as financial affairs, or a plenary guardianship, which covers all aspects of an individual’s life.

Do I need to file any documentation with the court?

Once you have the required medical evidence, you must file a guardianship petition, along with evidence of the individual’s condition, with the court. You also must have a summons served on the individual for whom you are seeking guardianship that gives him or her information about the case that you have filed with the court. Notice of the guardianship proceedings also must go to all close relatives of the individual, as well as to anyone with whom the individual is currently living. This can be a complex process, so it is best to work with a Helena estate planning attorney in order to obtain the desired outcome.

Will there be a hearing?

In most cases, a court will hold a guardianship hearing within 30 days of the filing of a guardianship petition. However, if there is an emergency situation, the court may appoint a temporary guardian for the individual until a court hearing is held. A temporary guardianship stays in place until a permanent guardianship is put into place or the guardianship petition is dismissed. In some cases, an expert witness in the form of a doctor or other medical care professional must appear and testify. If someone is contesting or objecting to guardianship, then there may be multiple court hearings until the case is resolved.

Are there ways to avoid the need for adult guardianship hearings?

If you engage in proper planning, however, you may be able to avoid an adult guardianship proceeding altogether. All too often, sudden medical events or accidents result in an inability of an individual to make appropriate financial or personal decisions. By signing Healthcare and Financial Powers of Attorney in advance and while you are still competent, you will give the person of your choice the power to make any important or necessary decisions on your behalf, without the necessity of a guardianship proceeding. Doing so will definitely save you time and money, particularly in the event of an unexpected situation.

Estate Planning Glossary

Helena estate planning attorney services cover a broad range of legal matters. Creating a comprehensive and legally sound estate plan often includes documents and strategies that are unfamiliar or misunderstood. To support better decision-making and peace of mind, we’ve created this glossary page. The following key terms are foundational to estate planning in Montana and reflect concepts our clients frequently discuss with us.

Helena estate planning attorney services cover a broad range of legal matters. Creating a comprehensive and legally sound estate plan often includes documents and strategies that are unfamiliar or misunderstood. To support better decision-making and peace of mind, we’ve created this glossary page. The following key terms are foundational to estate planning in Montana and reflect concepts our clients frequently discuss with us.

Last Will And Testament

A Last Will and Testament is a written legal document that communicates an individual’s final wishes regarding the distribution of their property, the care of any minor children, and the settlement of outstanding debts after death. It becomes effective only upon the testator’s death and must go through probate court. In Helena, Montana, estate planning attorneys regularly draft wills to make clear who the beneficiaries are and who will serve as the executor — the person responsible for carrying out the terms of the will. Without this document, state law decides how assets are divided, which may not align with the person’s wishes.

Power Of Attorney

Power of Attorney (POA) is a legal document authorizing someone to act on another person’s behalf in financial or medical matters. This authority may be temporary or long-term, depending on the specific language used. In estate planning, POA is critical for individuals who may become incapacitated due to age, illness, or accident. Financial POA allows the appointed agent to handle matters such as paying bills, managing investments, and handling banking transactions. A separate Healthcare POA covers medical decision-making when the person cannot speak for themselves. POAs must be created while the person still has the mental capacity to make decisions, which is why proactive planning is essential.

Revocable Living Trust

A Revocable Living Trust is a flexible legal arrangement that holds and manages an individual’s assets during their lifetime and distributes them after death, without the need for probate. Unlike a will, a trust becomes active immediately upon creation and can be altered or revoked at any time while the individual is still alive and mentally competent. With this tool, a person (the grantor) names a trustee to manage the assets and distribute them according to detailed instructions. Helena estate planning attorneys often recommend revocable trusts to clients who wish to avoid probate, maintain privacy, and maintain more direct control over how and when their assets are distributed to beneficiaries.

Healthcare Directive

Also called a Living Will, a Healthcare Directive is a written statement that outlines a person’s wishes regarding medical treatment if they are incapacitated and cannot communicate. This document typically addresses preferences for life-sustaining treatments, resuscitation efforts, and organ donation. In Helena, Montana, estate planning attorneys advise clients to use healthcare directives to avoid confusion or conflict among family members during medical emergencies. This directive works in tandem with a Healthcare Power of Attorney and provides clear guidance to healthcare providers and families about how to proceed under difficult circumstances.

Probate Court

Probate Court is a legal process through which a deceased person’s will is validated, debts are paid, and remaining assets are distributed to beneficiaries. If someone dies without a will (intestate), the court also oversees the distribution of assets according to state law. Probate proceedings are public, often lengthy, and can be costly due to court and attorney fees. This process can be simplified or avoided altogether with proper planning tools, such as trusts and beneficiary designations. Estate planning attorneys in Helena work to help clients create plans that reduce or eliminate the need for probate where possible.

We work with Montana residents to develop clear and effective estate plans that reflect their goals and values. Our team at Silverman Law Office, PLLC provides tailored guidance and legal support so you can make informed decisions that protect your family and assets.

Let’s talk about how we can help you build a personalized plan. Reach out today to schedule a consultation with a Helena estate planning attorney.

Contact Our Law Firm Today

Adult guardianship is a complex subject that also can be emotionally taxing for all parties involved. If you would like more information on this or any other estate planning issue, call Silverman Law Office, PLLC to schedule a free consultation with a dedicated Helena estate planning attorney.