Our team at Silverman Law Office, PLLC strives to make complex transitions for families more simple. We prepare clients for the life changes that may arise through establishing an estate plan. We can assist with matters related to guardianship, trusts, long-term estates, conservatorships, durable powers of attorney, retirement, and more. If you have questions on how to get started devising an estate plan, don’t hesitate to reach out to our Kalispell, MT trust lawyers. Our team is experienced in all things estate planning, and can help you begin as soon as today. If you are ready to prepare for the future of your assets so they are protected and distributed as you wish after your passing, now is the time to start. We hope to speak with you!

About Your Estate Plan

We have helped so many people just like yourself prepare an estate plan that meets their personal preferences and needs. We take into consideration non-tax and tax related goals. We tailor our client’s plans so that their wishes are fully expressed. We can be relied on as trusted advisors, giving clients peace of mind in knowing their assets and legacy will be distributed as intended. Depending on the circumstances, our plan can entail wills and revocable trusts, tax planning, life insurance, retirement accounts, healthcare and financial powers of attorney, review of asset titling, non-probate transfers, pet trusts, trusts for minors, drafting trust for special issues, and much more. Ultimately, if you are in need of something done that is estate planning related, our dedicated trust attorneys are ready to offer guidance.

Tax Planning For Wealth

Our team is knowledgeable in every area of wealth transfer taxes, such as gift tax, estate tax, generation skipping transfer tax (GST), and other income tax matters for trusts and estates. The laws and factors for wealth taxes can be complicated. Our team has the insight required to guide clients through income taxes and wealth transfer taxes by creating an effective succession and estate plan. We can administer trusts and estate efficiently and with our client’s best interests in mind. We know that protecting the wealth you have accumulated overtime is probably a top priority for you. After all, the more monetary assets you can safeguard and keep, the more can be transferred to your closest loved ones after your passing. If you have questions about this, please reach out at your next convenience.

Silverman Law Office, PLLC

At Silverman Law Office, PLLC, we serve clients, beneficiaries, fiduciaries, and heirs in all matters related to trust and estates. We can offer reliable counsel and advocate for your rights and options. We understand that planning for a future when you are no longer here may not be something you enjoy thinking about. However, estate planning is essential if you want to avoid the court having say in how your assets are handled later on. By having our MT trust attorneys help you establish a legally-binding estate plan, you can have peace of mind now that your wishes will be followed after your departure. To get started or have your questions answered, contact our team today.

Common Types Of Trusts And How A Trust Lawyer Can Help You Choose

Trusts are powerful tools in estate planning, offering flexibility in how assets are managed and distributed. They can provide benefits ranging from tax advantages to asset protection and ensure that your wishes are carried out after your death. However, with various types of trusts available, choosing the right one can be complex. Here’s a look at some common types of trusts and how a Kalispell, MT trust lawyer can help you select the best option for your needs.

1. Revocable Living Trust

A revocable living trust is one of the most common types of trusts. It allows you to retain control over the assets during your lifetime, with the ability to modify or revoke the trust as needed. Upon your death, the assets in the trust are transferred to the beneficiaries without going through probate, simplifying the process and maintaining privacy.

How a Trust Lawyer Can Help: A trust lawyer can assist in drafting a revocable living trust that reflects your specific wishes and ensures it complies with state laws. They can also provide guidance on how to properly fund the trust by transferring assets into it.

2. Irrevocable Trust

Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once it’s established. This type of trust removes assets from your estate, which can help reduce estate taxes and protect assets from creditors. It’s often used for charitable giving or to provide for a loved one with special needs.

How a Trust Lawyer Can Help: A trust lawyer can help you understand the implications of creating an irrevocable trust, including the potential tax benefits and limitations. They can guide you through the process of setting up the trust and ensure that it meets all legal requirements.

3. Testamentary Trust

A testamentary trust is created through a will and only comes into effect upon the death of the testator (the person who made the will). It is often used to manage assets for minor children or individuals who may not be capable of handling their inheritance.

How a Trust Lawyer Can Help: A trust lawyer can draft the testamentary trust as part of your will, ensuring that it is structured to meet your goals. They can also help you select the right trustee and outline how the trust assets should be managed and distributed.

4. Special Needs Trust

Special needs trusts are designed to provide financial support for individuals with disabilities without affecting their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI). This type of trust ensures that the individual’s quality of life is enhanced without jeopardizing their benefits.

How a Trust Lawyer Can Help: A trust lawyer can assist in setting up a special needs trust that complies with federal and state regulations. They can also provide guidance on how to properly fund the trust and manage it in a way that benefits the individual while preserving their eligibility for benefits.

Conclusion

Choosing the right type of trust is crucial in achieving your estate planning goals, whether it’s reducing taxes, protecting assets, or ensuring that your wishes are honored. A Kalispell trust lawyer from Silverman Law Office, PLLC provides invaluable assistance in selecting and setting up the appropriate trust for your needs, ensuring that it complies with legal requirements and reflects your personal and financial objectives.

How Trust Lawyers Can Help You Protect Your Assets For Future Generations

Protecting your assets for future generations is a vital part of estate planning, and one of the most effective tools for achieving this is through the creation of a trust. Trusts offer flexibility, control, and security, ensuring that your wealth is preserved and distributed according to your wishes. However, setting up and managing a trust involves complex legal considerations, which is why working with a trust lawyer is essential. Kalispell, MT trust lawyers provide expert guidance to help you structure your trust in a way that safeguards your assets for your heirs and future generations.

1. Expertise In Trust Creation

Trusts come in many forms, each with its own advantages and disadvantages depending on your financial situation, family dynamics, and estate planning goals. A trust lawyer can help you navigate these options, ensuring that you choose the right type of trust to meet your needs. Whether it’s a revocable trust, which allows you to maintain control over your assets during your lifetime, or an irrevocable trust, which offers significant tax benefits and asset protection, a trust lawyer will provide the expertise needed to establish a solid foundation for your estate plan.

2. Asset Protection Strategies

One of the primary reasons people establish trusts is to protect their assets from creditors, lawsuits, or other potential financial threats. Trust lawyers are skilled in crafting trusts that shield your wealth from these risks. For instance, by placing assets in an irrevocable trust, you can remove them from your personal estate, making them inaccessible to creditors.

3. Minimizing Tax Liabilities

Trusts can be powerful tools for reducing estate and gift taxes, which can significantly diminish the value of your estate passed on to your heirs. A trust lawyer will work with you to develop a tax-efficient estate plan that leverages the benefits of trusts to minimize your tax liabilities. For example, by setting up a generation-skipping trust, you can transfer wealth directly to your grandchildren, bypassing your children’s estate and reducing the overall tax burden. Trust lawyers stay up-to-date with the latest tax laws and regulations, ensuring that your estate plan is as tax-efficient as possible.

4. Ensuring Proper Trust Management

Creating a trust is only the first step; proper management is crucial to ensuring that your assets are protected and distributed according to your wishes. A trust lawyer can help you appoint a reliable trustee, who will be responsible for managing the trust’s assets, handling investments, and making distributions to beneficiaries. If you prefer, a trust lawyer can also serve as your trustee, providing professional management to ensure that your trust is administered correctly and in line with your intentions.

Conclusion

Kalispell trust lawyers play a crucial role in helping you protect your assets for future generations. From selecting the right type of trust and implementing asset protection strategies to minimizing tax liabilities and ensuring proper trust management, a trust lawyer’s expertise is invaluable in securing your legacy. By working with a trust lawyer from Silverman Law Office, PLLC, you can have peace of mind knowing that your wealth will be preserved and passed on according to your wishes, providing for your loved ones and safeguarding your family’s financial future.

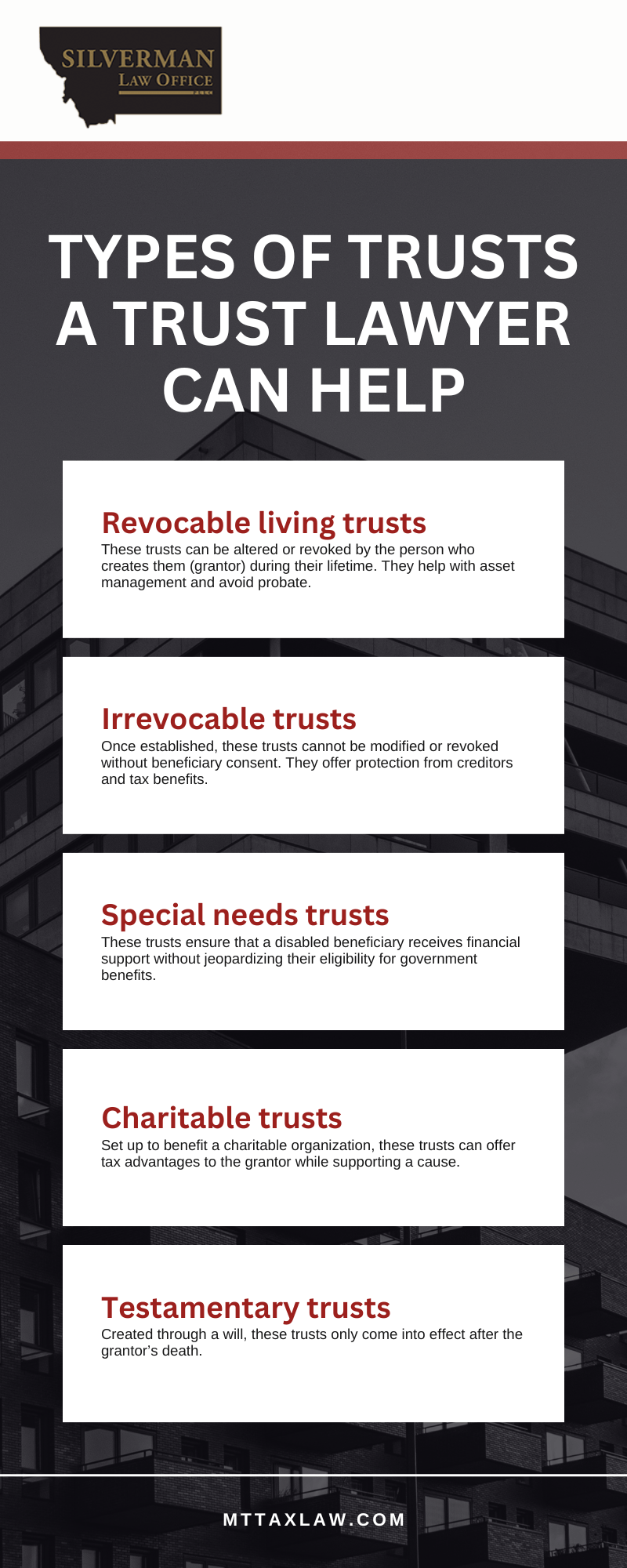

Kalispell Trust Infographic

Trust Lawyers: Frequently Asked Questions (FAQ)

1. What Is A Trust Lawyer?

A Kalispell trust lawyer is a legal professional who specializes in creating and managing trusts for clients. Trusts are legal arrangements where one party (the trustee) holds and manages assets on behalf of another (the beneficiary). Trust lawyers help individuals set up trusts to manage their assets, protect wealth, reduce estate taxes, and ensure their financial wishes are followed after their passing. Trusts are often part of estate planning and can help avoid the probate process.

2. What Does A Trust Lawyer Do?

Trust lawyers provide several key services, including:

- Creating different types of trusts based on the client’s needs (e.g., revocable, irrevocable, special needs, or charitable trusts).

- Advising on the legal and financial benefits of setting up a trust.

- Drafting the necessary legal documents to ensure the trust is valid.

- Helping clients manage and update their trusts over time as their financial situation or family circumstances change.

- Assisting trustees with the administration of trusts, including managing assets, distributing funds to beneficiaries, and adhering to legal obligations.

3. Why Should I Set Up A Trust?

There are many reasons why individuals set up trusts. Common benefits include:

- Avoiding probate: Trusts can help bypass the probate process, which can be time-consuming and costly. This allows beneficiaries to receive assets more quickly.

- Privacy: Unlike wills, trusts are not made public during the probate process, which helps keep financial affairs private.

- Tax planning: Trusts can be structured to minimize estate and inheritance taxes, helping to preserve more wealth for beneficiaries.

- Protecting assets: Trusts can protect assets from creditors or legal claims and ensure they are distributed according to the client’s wishes.

- Providing for loved ones: Trusts can be set up to care for children, disabled individuals, or elderly parents, ensuring that financial needs are met.

4. What Types Of Trusts Can A Trust Lawyer Help Me Set Up?

A trust lawyer can assist with creating various types of trusts, including:

- Revocable living trusts: These trusts can be altered or revoked by the person who creates them (grantor) during their lifetime. They help with asset management and avoid probate.

- Irrevocable trusts: Once established, these trusts cannot be modified or revoked without beneficiary consent. They offer protection from creditors and tax benefits.

- Special needs trusts: These trusts ensure that a disabled beneficiary receives financial support without jeopardizing their eligibility for government benefits.

- Charitable trusts: Set up to benefit a charitable organization, these trusts can offer tax advantages to the grantor while supporting a cause.

- Testamentary trusts: Created through a will, these trusts only come into effect after the grantor’s death.

5. Do I Need A Trust Lawyer To Manage My Trust After It’s Established?

While it’s not legally required to have a lawyer manage your trust, it’s often beneficial. Trust administration involves adhering to strict legal and fiduciary obligations, and a lawyer can help ensure that all requirements are met. For example, trust lawyers can assist trustees in managing investments, filing tax returns, and distributing assets in line with the terms of the trust.

If you need the assistance of Kalispell trust lawyers, get in touch with the professionals at Silverman Law Office, PLLC.