Your Dedicated Estate Planning Lawyer

When you are planning your estate, our trusted Great Falls, MT estate planning lawyer knows that a DIY estate plan can go horribly awry. It’s easy to fall into the trap of believing that creating your own estate plan will take less amount time and save you a great deal in the long run. Why pay a lawyer to do what the internet can do, right? However, you may quickly find that these DIY estate planning templates will not have everything that you need and will likely not be able to fulfill all of the requirements that your state needs to be fulfilled for an estate plan. When you want to see what a lawyer can do for you, reach out to Silverman Law Office, PLLC for more information.

When you are planning your estate, our trusted Great Falls, MT estate planning lawyer knows that a DIY estate plan can go horribly awry. It’s easy to fall into the trap of believing that creating your own estate plan will take less amount time and save you a great deal in the long run. Why pay a lawyer to do what the internet can do, right? However, you may quickly find that these DIY estate planning templates will not have everything that you need and will likely not be able to fulfill all of the requirements that your state needs to be fulfilled for an estate plan. When you want to see what a lawyer can do for you, reach out to Silverman Law Office, PLLC for more information.

When it comes to securing your family’s future and making sure that your hard-earned assets are distributed as per your wishes, our trusted Montana estate lawyer can be your greatest ally. Our experienced and dedicated team is here to guide you through the intricacies of estate planning, allowing you to make informed decisions for the benefit of your loved ones.

Crafting A Customized Estate Plan

We believe that estate planning is not a one-size-fits-all endeavor. We take the time to understand your specific needs, goals, and family dynamics to create a personalized estate plan that addresses your concerns. Whether you require a simple will, a trust, or a more complicated estate planning strategy, we have the experience to make sure your wishes are upheld.

Protecting Your Assets And Legacy

Our estate planning lawyers are dedicated to safeguarding your assets and preserving your legacy. We help you manage the rules of tax laws and asset protection, minimizing potential liabilities and maximizing the inheritance your loved ones receive. With our guidance, you can have peace of mind knowing that your hard-earned wealth is in capable hands.

Planning For Incapacity

Estate planning isn’t just about what happens after you pass away; it also involves planning for potential incapacity due to illness or injury. Our team can assist you in establishing powers of attorney and advance healthcare directives, so that your affairs are managed according to your wishes if you become unable to make decisions for yourself.

Administering Estates Efficiently

In addition to helping you plan for the future, our Great Falls estate planning attorney can also guide your loved ones through the probate and estate administration process. We understand that this can be a challenging time, and our compassionate approach makes sure that your family’s interests are protected throughout the proceedings.

Take Control Of Your Legacy Today

We take pride in our reputation for excellence and our commitment to client satisfaction. We provide top-notch legal guidance to their employees and clients, ensuring their assets are secure for generations to come.

Don’t leave the future of your estate to chance. Our estate planning lawyers are ready to assist you in creating a comprehensive plan that reflects your wishes and protects your loved ones. Contact us today to schedule a consultation and take the first step towards securing your legacy. Our experienced estate planning attorneys provide tailored solutions to meet your unique needs, so that your legacy is preserved for generations to come. With the support of our dedicated team, you can take control of your estate and enjoy peace of mind. Contact us today to schedule a consultation and embark on your estate planning journey.

What Is Estate Planning?

Estate planning is an important process that makes sure your assets are distributed according to your wishes upon your passing. It involves legal structures like wills, trusts, and powers of attorney. Understanding the essentials of estate planning can be challenging, which is why it’s important to speak with our Great Falls estate planning lawyer for support. Here’s an overview of what everyone needs to know about estate planning:

Why Estate Planning Is Important

Estate planning is the process of arranging the management and disposal of your estate during your life and after death. It’s important because it allows you to verify that your assets are distributed according to your wishes, reduces taxes, and helps your loved ones avoid complicated legal processes. As our team from Silverman Law Office, PLLC, will share, effective estate planning gives you peace of mind knowing that your assets are protected and your family’s future is secure.

How A Will Differs From A Living Trust

A will is a legal document that specifies how your assets should be distributed after your death. It becomes effective only after you pass away. A living trust, on the other hand, is effective immediately upon creation. It allows you to manage your assets during your lifetime and dictates distribution after your death. Living trusts are often preferred for their ability to avoid probate, which can be a lengthy and costly process.

Updating Your Estate Plan

Life changes such as marriage, divorce, birth of a child, or acquisition of significant assets necessitate updates to your estate plan. Regularly reviewing and updating your plan with our attorney makes sure it always reflects your current situation and wishes. Remember, an outdated estate plan can be as problematic as having no plan at all.

The Risks Of DIY Estate Planning

It’s easy to focus on the positives of a DIY estate plan. You can throw it together on your own in an afternoon and you may have only paid a hundred bucks to download the template. Easy, right? Before you do this, consider what could go wrong if you do not have a lawyer guiding you through the process.

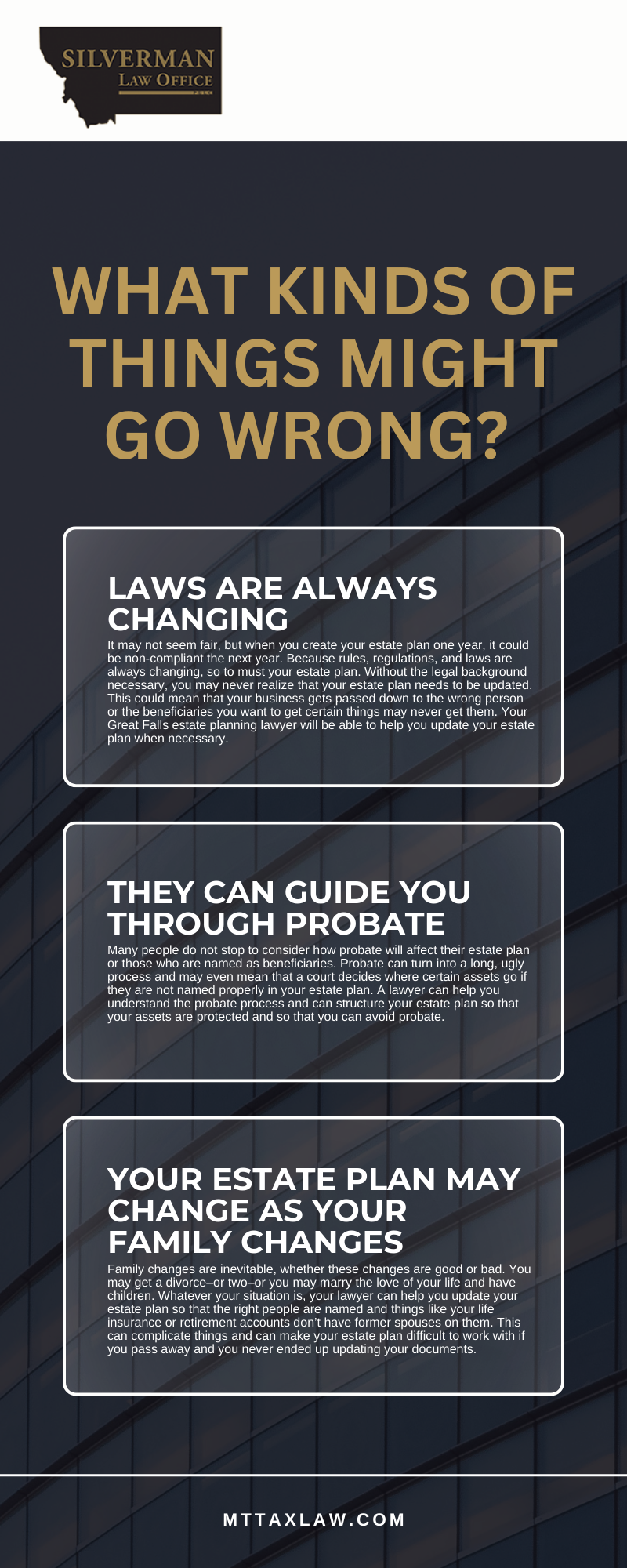

- Changing Laws. It may not seem fair, but when you create your estate plan one year, it could be non-compliant the next year. Because rules, regulations, and laws are always changing, so to must your estate plan. Without the legal background necessary, you may never realize that your estate plan needs to be updated. This could mean that your business gets passed down to the wrong person or the beneficiaries you want to get certain things may never get them. Our estate planning attorney will be able to help you update your estate plan when necessary.

- Pitfalls In Probate. Many people do not stop to consider how probate will affect their estate plan or those who are named as beneficiaries. Probate can turn into a long, ugly process and may even mean that a court decides where certain assets go if they are not named properly in your estate plan. Our probate lawyer can help you understand the probate process and can structure your estate plan so that your assets are protected and so that you can avoid probate.

- Failing To Make Necessary Updates To Your Plan. Family changes are inevitable, whether these changes are good or bad. You may get a divorce–or two–or you may marry the love of your life and have children. Whatever your situation is, our lawyer can help you update your estate plan so that the right people are named and things like your life insurance or retirement accounts don’t have former spouses on them. This can complicate things and can make your estate plan difficult to work with if you pass away and you never ended up updating your estate planning documents.

Don’t leave things to chance when you are working on your estate plan. Instead, reach out to our trusted Great Falls estate planning lawyer at Silverman Law Office, PLLC when you are ready to move forward.

Looking For An Estate Planning Attorney

Choosing the right estate planning lawyer is essential. Look for a lawyer with a strong track record and excellent client reviews. A good lawyer should understand your unique needs, offer tailored advice, and confirm that your estate plan is comprehensive and legally sound.

Estate planning is a profound step towards securing your legacy and protecting your loved ones’ future. Since our founding in May 2012, Silverman Law Office, PLLC, has remained committed to guiding clients through each stage of this important journey. Our experienced team will work closely with you to create an estate plan that meets your specific needs and gives you peace of mind.

If you’re ready to start your estate planning journey or have more questions, don’t hesitate to reach out to us. Together, we will make sure your legacy is preserved exactly as you envision.

Great Falls Estate Planning Infographic

Great Falls Estate Planning Statistics

According to national statistics, approximately 85 percent of successful business owners have outdated estate plans. This issue can lead to significant issues for their family because of changes in both their personal circumstances and changes in tax laws.

To update your estate plan, call our office to speak with our estate planning attorneys.

Estate Planning FAQs

Estate planning is a critical aspect of financial management that ensures an individual’s assets are distributed according to their wishes upon their passing. This process involves drafting documents like wills and trusts to outline the distribution of assets, care for minors, and even directives for personal care if one becomes incapacitated. Our experienced estate planning legal team can provide invaluable guidance to navigate the complexities of estate laws, ensuring that the plan aligns with legal requirements while reflecting the individual’s desires.

What Happens If You Don’t Have An Estate Plan?

Without an estate plan, state laws determine how your assets are distributed, which may not align with your wishes. Your family could face lengthy legal processes, and your estate might incur more taxes and legal fees. Creating an estate plan with our legal team makes sure that your intentions are clear, legally binding, and that your loved ones are taken care of according to your desires.

How Do Assets Get Distributed Through Estate Planning?

When considering the distribution of assets, many wonder what items can be included in their estate plan. Essentially, most types of assets can be incorporated into a will, from tangible property to digital assets. This includes real estate, bank accounts, investments, personal property, and even sentimental items. A detailed estate plan can help minimize potential disputes among heirs and ensure that specific legacies are preserved as intended. Continue reading to discover some of the most frequently asked questions about what can be included in a will.

Can I Include My Home And Other Real Estate In My Will?

Yes, real estate is one of the most common assets included in wills. Whether it’s a primary residence, vacation home, or investment property, specifying who will inherit these assets can prevent future disputes and complications in the estate distribution process.

What About My Bank Accounts And Investments?

Bank accounts, stocks, bonds, and other investment vehicles can also be specified in a will. It’s important to provide clear instructions on how these assets should be handled, whether they are to be transferred to specific individuals or liquidated to contribute to the estate’s overall value.

How Do I Ensure My Personal Belongings Are Distributed As I Wish?

Personal belongings, such as jewelry, art, collectibles, and other items of sentimental or monetary value, can be included in a will with detailed instructions for their distribution. This makes sure that heirlooms and personal items are passed on according to your wishes.

Can I Include Provisions For My Children In My Will?

Absolutely. A will is an important document for appointing guardians for minor children in the event of the parents’ untimely demise. It allows parents to make sure their children are cared for by trusted individuals and can also include instructions for financial support and education funding. This is an essential thing to speak with our Great Falls estate planning lawyers, as your children are the most important people to look out for.

Estate Planning Law Glossary

Planning for the future involves more than just thinking about what happens to your belongings after you’re gone. A Great Falls, MT estate planning lawyer often meets with individuals and families who feel uncertain about the legal terms used in wills, trusts, and other important documents. We created this glossary to help explain some of the phrases and concepts that come up frequently during the estate planning process so you can feel more confident when making decisions about your legacy and your loved ones.

Planning for the future involves more than just thinking about what happens to your belongings after you’re gone. A Great Falls, MT estate planning lawyer often meets with individuals and families who feel uncertain about the legal terms used in wills, trusts, and other important documents. We created this glossary to help explain some of the phrases and concepts that come up frequently during the estate planning process so you can feel more confident when making decisions about your legacy and your loved ones.

Living Trust

A living trust is a legal arrangement that allows you to place assets into a trust during your lifetime and specify how those assets should be managed and distributed. Unlike a will, which only takes effect after you pass away, a living trust becomes active as soon as it is created. You can serve as the trustee of your own living trust, maintaining control over your assets while you’re alive and capable.

One of the main reasons people choose living trusts is to avoid probate, which can be a lengthy and costly court process. Assets held in a living trust pass directly to your named beneficiaries without going through probate court. This can save time and money for your family and keeps the details of your estate private. A Great Falls, MT estate planning lawyer can help you determine whether a living trust fits your situation and draft the document to reflect your specific wishes.

Powers Of Attorney

A power of attorney is a legal document that grants another person the authority to make decisions on your behalf. This can cover financial matters, such as managing bank accounts and paying bills, or it can be limited to specific transactions. The person you designate is called your agent or attorney-in-fact, and they step in when you are unable or unavailable to handle matters yourself.

There are different types of powers of attorney, including durable powers of attorney that remain in effect even if you become incapacitated. Without this document in place, your family may need to go to court to obtain the legal authority to manage your affairs during a health crisis. Having a power of attorney prepared in advance gives you control over who makes decisions for you and under what circumstances.

Advance Healthcare Directive

An advance healthcare directive is a document that outlines your wishes for medical care if you become unable to communicate or make decisions for yourself. This can include instructions about life-sustaining treatment, resuscitation, and other medical interventions. It may also designate a healthcare agent who can make medical decisions on your behalf.

Creating this document while you are healthy allows you to think carefully about your preferences and communicate them clearly. Without an advance directive, family members may be left guessing about what you would have wanted, which can lead to disagreement and stress during an already difficult time. A Great Falls, MT estate planning lawyer can help you draft this document so that your healthcare preferences are legally documented and respected.

Probate

Probate is the legal process through which a deceased person’s estate is administered and distributed. During probate, a court oversees the validation of the will, the payment of debts, and the transfer of assets to beneficiaries. This process can take months or even years depending on the size and complexity of the estate.

Many people try to structure their estate plans to minimize or avoid probate because of the time, expense, and public nature of the process. Assets held in certain types of trusts, accounts with designated beneficiaries, and jointly owned property can often bypass probate entirely. Working with an attorney to understand how probate works in Montana can help you make informed choices about how to structure your estate.

Guardian Designation

A guardian designation is a provision in your estate plan that names the person you want to care for your minor children if something happens to you. This is one of the most important decisions parents can make, and having it documented in a will or other legal document gives the court clear guidance about your wishes.

Without a guardian designation, a court will decide who raises your children based on what they determine to be in the child’s best interest. This may not align with what you would have chosen. Naming a guardian also allows you to consider factors like values, location, and the relationship your children have with that person.

If you have questions about any of these terms or want to discuss your estate planning goals, the team at Silverman Law Office, PLLC is here to help. Reach out today to schedule a consultation and take the first step toward protecting your legacy.

Contact Our Estate Planning Attorney Today

Estate planning is more than just preparing for the unforeseen; it’s about providing for loved ones and ensuring that one’s legacy is honored. Our dependable Great Falls estate planning attorneys at Silverman Law Office, PLLC can offer the insights needed to manage these decisions, making sure that every aspect of an estate plan is legally sound and aligns with the individual’s wishes. Attorney Joel Silverman has dedicated his legal career since 2003 to helping individuals protect what matters most—with integrity, care, and practical legal guidance. If you have yet to begin this vital process or have questions about updating an existing plan, now is the time to take action. Reach out for a consultation to explore how your assets, including real estate, investments, personal belongings, and provisions for children, can be effectively managed and protected through comprehensive estate planning. Providing peace of mind for you and your loved ones begins with a well-crafted estate plan.